If you don’t have the funds, you’re not going to complete the project successfully. That’s why a project budget is so important: it’s the lifeblood of the project. Follow these steps to secure the funds necessary to support the project through every phase. But first, we need to define what a project budget is.

What Is a Project Budget?

A project budget is the total projected costs needed to complete a project over a defined period of time. It’s used to estimate what the costs of the project will be for every phase of the project. Creating a project budget is a critical part of the project planning process.

The project budget will include such things as labor costs, material procurement costs and operating costs. But it’s not a static document. Your project budget will be reviewed and revived throughout the project, hopefully with the help of project budgeting software.

Get your free

Project Budget Template

Use this free Project Budget Template to manage your projects better.

Get the template

Why You Need a Project Budget

The obvious answer is that projects cost money, but it’s more nuanced than that. The project budget is the engine that drives your project’s funding. It communicates to stakeholders how much money is needed and when it’s needed. Project budgets are important for any industry such as construction, marketing or manufacturing, for example.

But a project budget is not only a means to get things that your project requires. Yes, you need to pay teams, buy or rent equipment and materials, but that’s only half the story. The other part of the importance of a project budget is that it’s an instrument to control project costs. The budget, which is part of your project plan, acts as a baseline to measure your performance as you collect the actual costs once the project has been started.

Who Is Involved in Setting and Managing a Project Budget?

Several key stakeholders are typically involved in setting and managing project budgets. First, the project sponsor (such as a senior executive or manager) will secure and approve the initial project funding. They outline the project’s financial expectations and limitations. The sponsor also has the authority to approve major budget revisions or the allocation of contingency funds.

Then, the project manager will develop a detailed budget. They create a budget plan and break down the project scope and estimate costs for tasks, resources and deliverables. They will manage the budget throughout the project and provide regular financial reports to the sponsor and other stakeholders. The project team may also be involved, as team members with specific expertise can contribute to estimating the costs associated with their tasks and required resources.

What Is Project Budgeting?

Project budgeting is the process of estimating the full cost of the project from the very beginning until the end. The project budgeting process involves the following:

- Budget planning: Estimating costs and making a budget based on a project estimate

- Budget tracking: Keeping track of project expenses during the project execution phase

- Project budget management: Setting guidelines and control procedures to guarantee that costs don’t exceed the project budget

Project Budgeting Approaches

There are four project budgeting approaches: analogous, parametric, top-down and bottom-up. Analogous is an estimating technique that uses historical data to help determine the cost of the current project. It looks at past projects that are similar to figure out the cost and duration of the new project. This is a popular choice when there’s little data available for the project, making accurate estimates difficult.

Parametric estimating is a statistical approach to estimating the time, cost and resources for a project. It uses historical data, but also statistical data, to make a more accurate estimate. Top-down estimating is when the organization sets the cost and/or the duration of the project. With that figure in mind, the project manager seeks expert opinions to help determine the budget. Finally, bottom-up estimating is working from the lowest possible level of detail. It builds up the estimate from the work package.

What Is Project Budget Management?

Project budget management is a process by which the finances related to the project are administered and overseen. It goes beyond estimating the cost of completing the project and includes tracking those costs and much more. Some of the aspects of project budget management include how you’ll estimate the cost of the project and how those costs will be spread across the life cycle of the project. You’ll need to determine the metrics and the method by which you’ll track those costs to keep to the budget.

Reporting on the budget is also part of project budget management, including how you’ll do it and the frequency with which you’ll do it. If you find you’re going over budget, you’ll need to come up with a plan to rein the budget back in. You’ll even need to define a process of learning from historical data.

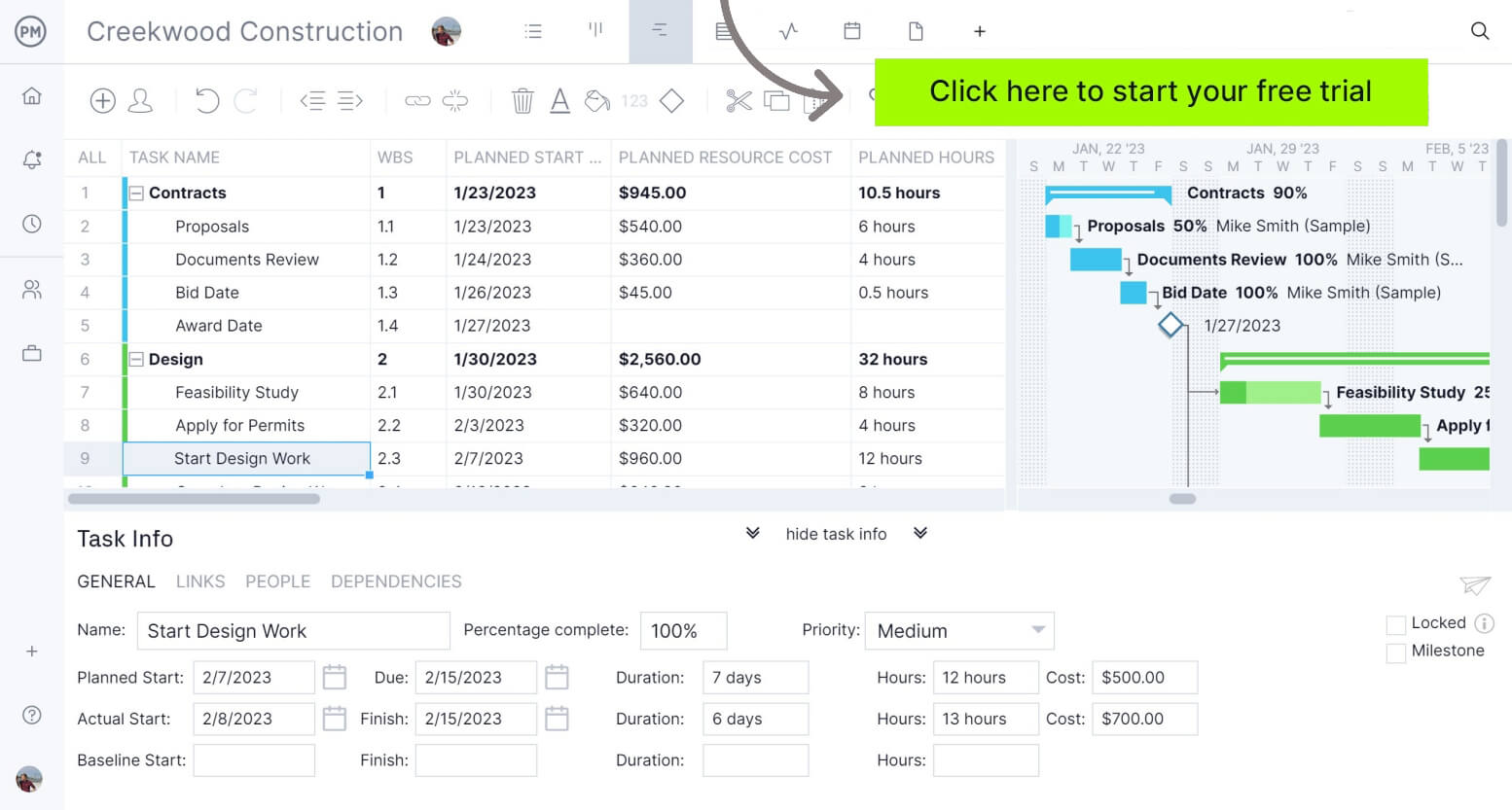

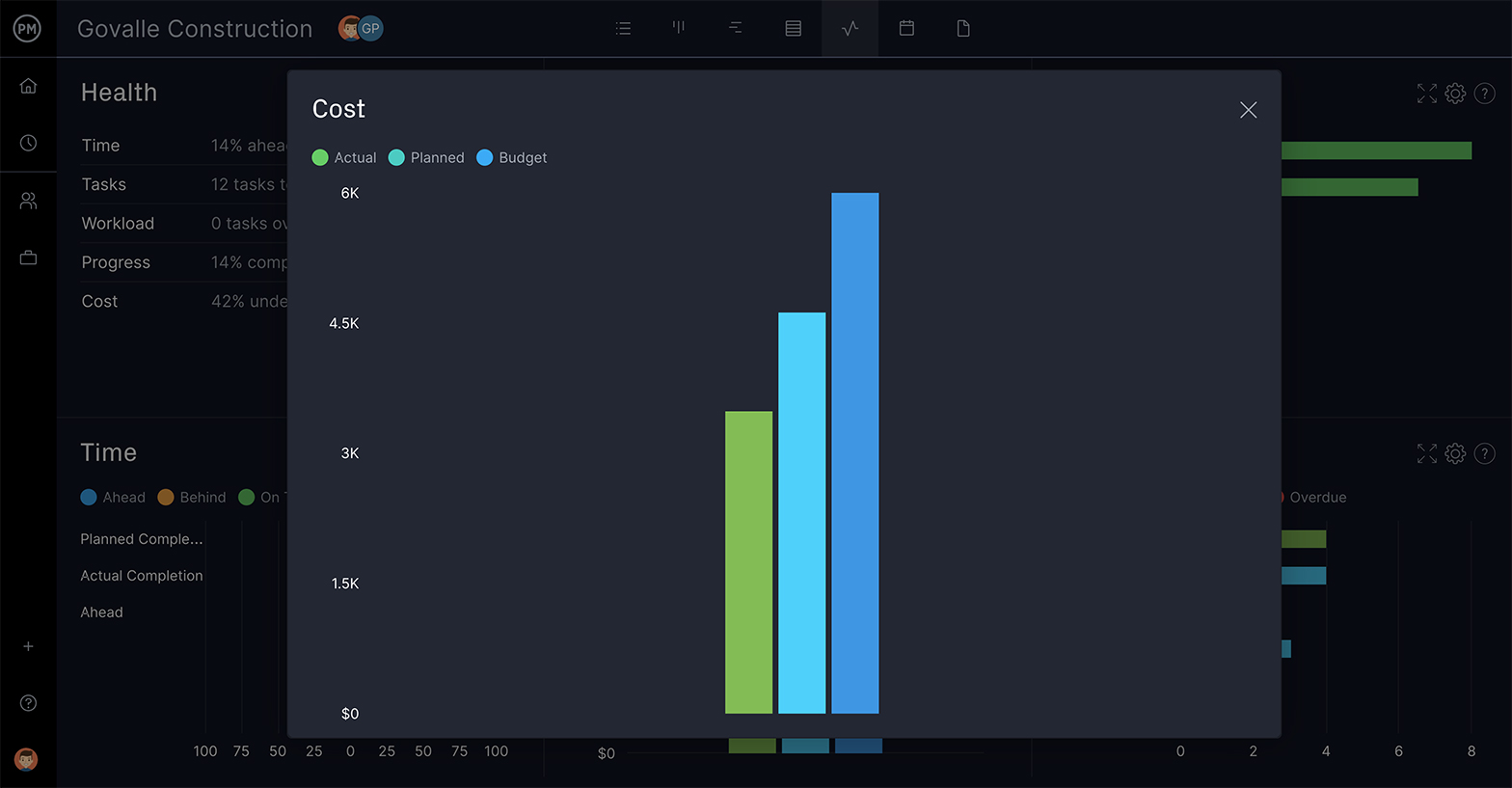

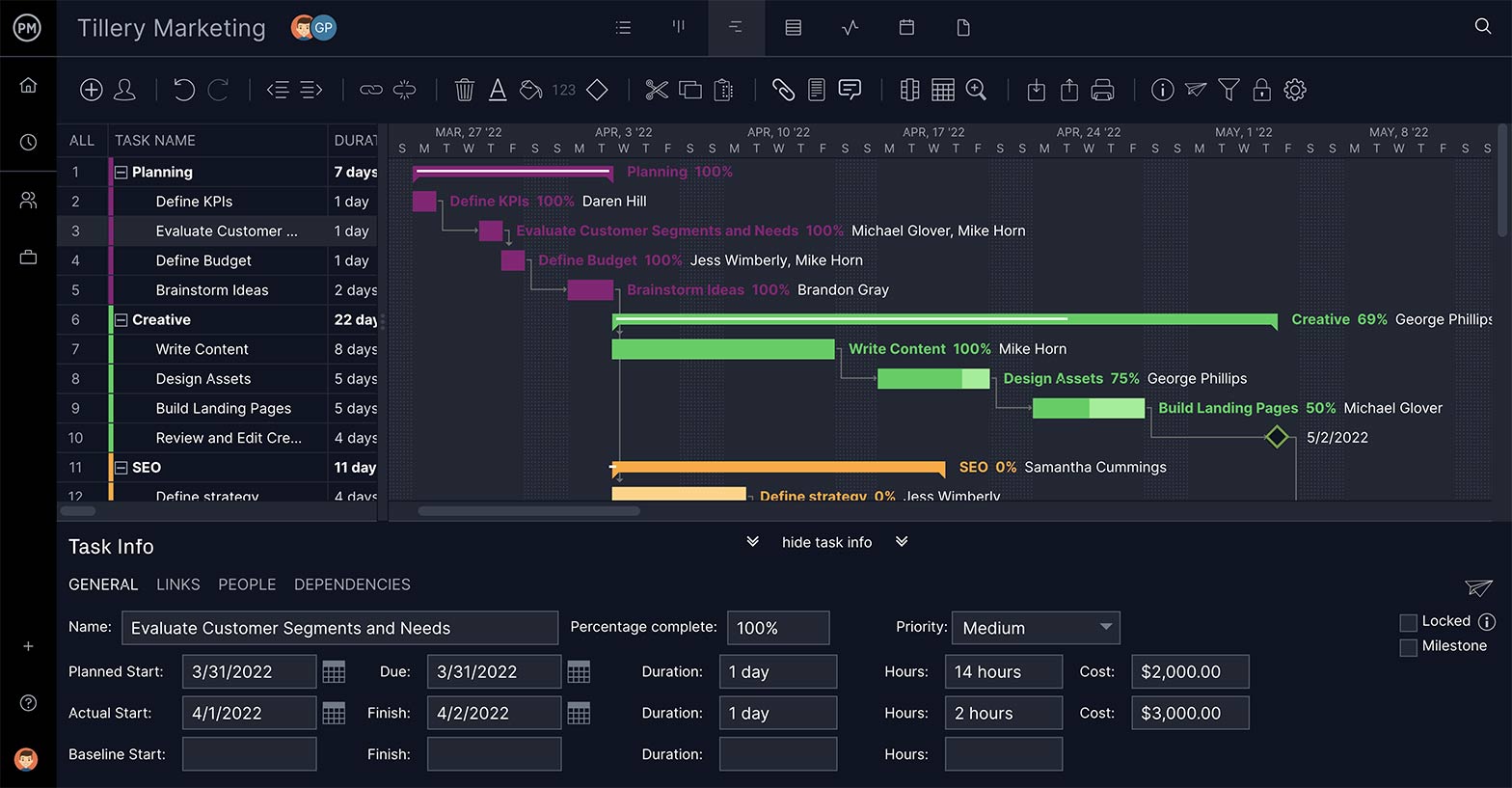

Project management software simplifies project budgeting and project budget management. Take ProjectManager; all you have to do is open up the settings on your Gantt and set a budget baseline. Now you have the planned effort saved and you can use budget tracking features such as real-time dashboards to compare it to your actual effort as you execute the project. You can reset the baseline as many times as you need during the project to always be able to measure your project variance instantly. Get started today for free.

How to Make a Project Budget

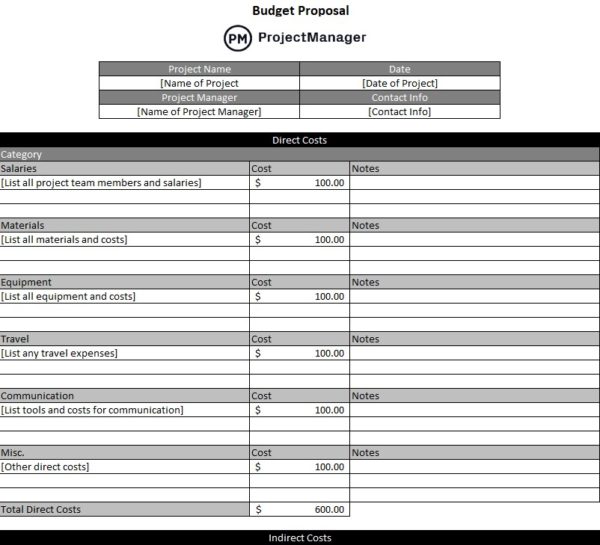

As noted, there are many components necessary to build a budget, including direct and indirect costs, fixed and variable costs, labor and materials, travel, equipment and space, licenses and whatever else may impact your project expenses.

To meet the financial needs of your project, a project budget must be created thoroughly, not missing any aspect that requires funding. We’ve outlined seven essential steps toward creating and managing your project budget:

1. Use Historical Data

Your project is likely not the first to try and accomplish a specific objective or goal. Looking back at similar projects and their budgets is a great way to get a headstart on building your budget.

2. Reference Lessons Learned

To further elaborate on historical data, you can learn from their successes and mistakes. It provides a clear path that leads to more accurate estimates. You can even learn about how they responded to changes and kept their budget under control. Here’s a lessons learned template if you need to start tracking those findings in your organization.

3. Leverage Your Experts

Another resource to build a project budget is to tap those who have experience and knowledge—be they mentors, other project managers or experts in the field. Reaching out to those who have created rough order of magnitude estimates and budgets can help you stay on track and avoid unnecessary pitfalls.

4. Confirm Accuracy

Once you have your budget, you’re not done. You want to look at it and ensure your figures are accurate. You can use our project budget proposal template for this process. You can also seek those experts and other project team members to check the budget and make sure it’s right.

5. Baseline and Re-Baseline the Budget

Your project budget is the baseline by which you’ll measure your project’s progress once it has started. It’s a tool to gauge the variance of the project. But, as stated, you’ll want to re-baseline as changes occur in your project. Once the change control board approves any change you need to re-baseline.

6. Update in Real Time

Speaking of changes, the sooner you know about them, the better. If your project planning software isn’t cloud-based and updating as soon as your team changes its status, then you’re wasting valuable and expensive time.

7. Get on Track

The importance of having a project management software that tracks in real time, like ProjectManager, is that it gives you the information you need to get back on track sooner rather than later. Things change and projects go off track all the time. It’s the projects that get back on track faster that are successful.

If you manage your project expenses using these building blocks you’re going to have a sound foundation for your project’s success.

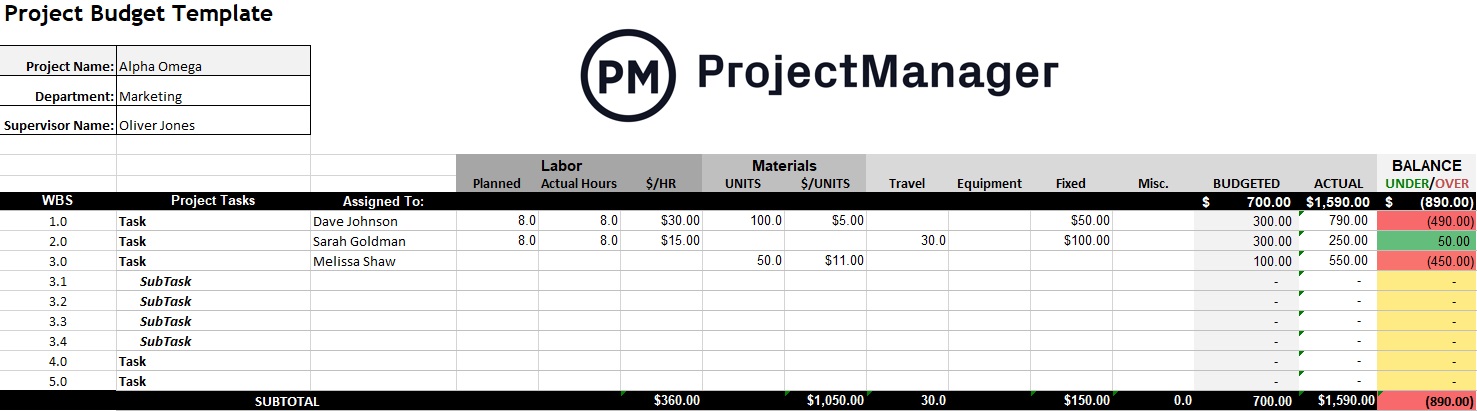

Project Budget Template

If you want help getting your budget together, ProjectManager has a free project budget template that lays out most of the basics for you. For additional support, try our free project budget template.

Project Budget Example

To further illustrate how a project budget is created, let’s pretend we’re making an app. The first thing you’ll need to figure out is the costs of labor and materials. You’ll need programmers, designers, content developers, a dev team, etc. It helps list all the tasks and assign the team to them—a hallmark of good task management. This way every penny is accounted for.

With the tasks broken down for the project and your team in place, you’ll next need to look into whatever materials will be needed. Will they need laptops, other devices and equipment? This must be accounted for.

Now note other line items. There might be travel expenses and renting space to house the team. Then there are fixed items that are true for any project. These are things where the cost is set and won’t change over the course of the project. You’ll also want a column for any miscellaneous costs that don’t fit elsewhere in the budget.

Your budget must have a planned versus actual column. When you’re making that app you’ve likely to pivot and that is going to impact the budget. These columns are a way to track the expenditure to ensure you’re staying on budget.

How to Manage a Project Budget

When managing a project budget, use a continuous process of planning, tracking, controlling and adjusting finances. During the planning stage, define the project scope and understand the deliverables, tasks and requirements. A work breakdown structure (WBS) can help break the project down into smaller, more manageable tasks to estimate costs more accurately. Each project activity should also have cost estimations such as labor, material, travel, equipment, subcontractor or software costs.

While we touched on documents and how they’re essential for tracking, be sure to specifically use timesheets, invoices from suppliers and subcontractors, receipts for materials and expense reports.

Analyzing budget performance may consist of comparing planned vs. actual costs and calculating the variance between them. This helps identify trends and can outline if certain types of expenses are consistently under or over budget.

Controlling a Project Budget

When controlling a project budget, establish change control procedures, or a formal process for managing changes to the scope, schedule and budget. Control can also consist of regular budget reviews, negotiating better supplier rates and contingency management. More complex projects may benefit from earned value management (EVM) to track the project performance against the baseline schedule and budget simultaneously.

Finally, when adjusting the project budget, develop a plan if an overrun is projected. This could mean cost-cutting measures, scope adjustments (pending approval) or getting additional funding.

Project Budget vs. Project Estimate

We’ve spent a lot of time talking about project estimates, but how do they differ from the project budget? A project estimate is what you think the project will cost. It’s the first step when making a project budget, so you want that project estimate to be as accurate as possible. Once you’ve done the research, looked at historical data and all the activities and resources needed to execute them, you’ll submit that estimate to be approved as your budget. But it’s only a guideline, while the project budget is a firm figure.

Project Budget vs. Budget Proposal

Again, when you’re talking about a project budget you’re talking about all the expenditures that are needed to deliver the project. It defines how the money for the project will be allocated. A budget proposal, on the other hand, is the best estimate of the costs required to complete the project. It’s similar to the aforementioned project estimate in that it’s the final project estimate, the one that’ll be presented to stakeholders. They’ll then determine if the figure matches what they think is viable and either approve it or reject it.

More Project Budgeting Templates

Project budgeting is one of the most important aspects of project management, no matter what industry you’re in. However, your project budget might look slightly different depending on the type of project you’re managing. Here are some free project budgeting templates for marketing, event planning and construction.

Marketing Budget Template

This marketing budget template is a great tool to start creating accurate baselines for your marketing campaigns. You can customize it to fit the needs of your team.

Event Budget Template

Like a project, an event requires resources that cost money. This free event budget template helps you list down the costs related to your event such as equipment rental, materials and labor.

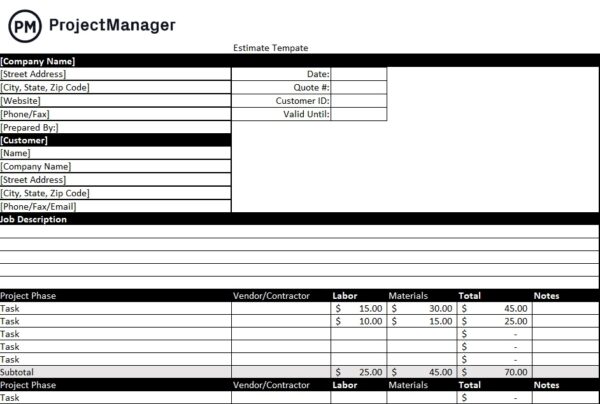

Construction Estimate Template

Estimating the costs of a construction project is one of the most important construction planning activities there are, as an accurate cost estimation allows construction firms to make sure their project is not only feasible, but profitable. This free construction estimate template is a great tool to start estimating the costs of your construction project.

Project Budgeting Tips

A project budget is extremely important; without the funds to execute a project, it’s dead in the water. We’ve explained what a project budget is, and how to make one and we’ve provided examples. But when you’re in the thick of it, you need tips. These will help you with project budgeting.

- Document your process when putting together a budget. Documents are essential for tracking the project and reviewing the outcomes.

- Create contingencies. Have a plan B in place. There will always be unexpected costs, delays and other issues that’ll impact your budget.

- Project budgeting is a team effort. Seek advice from your team, as they’re the ones with experience executing projects. Meet with experts who can provide you with guidance. Any person or organization that has insight should be tapped for their expertise.

- Know your resources and their associated costs. This includes any maintenance required for equipment, and don’t forget your team is also a resource. Know their availability, overtime potential and other overhead costs.

- When estimating costs don’t forget about task duration. These are also estimates and can greatly impact the budget.

- The budget is a great tool for tracking performance. It can even be used as a communication tool for teams across departments.

ProjectManager Helps Projects Stay on Budget

ProjectManager is online project management software. That means we deliver data instantly to our real-time dashboard, so you can monitor your project across six metrics. When actual costs vary from your planned budget, you know faster and can respond quicker.

You can also plan your budget on our software, adding expenses and then use our resource management feature to assign resources, workforce and hourly rates, which are automatically added to your project. Add expenses at the task level with our Gantt chart, and report on expenses at the task level, too.

Video: Project Budgeting Tips

It’s clear that building an accurate budget is key to setting up your project to succeed. Why not take a moment to listen to our resident project management expert Jennifer Bridges, PMP, who explains how to build a project budget in this tutorial video.

Thanks for watching!

Pro tip: Be sure to track the budgeted vs. actual costs when you’re in the project to see if you’re adhering to that budget. Because after you make a budget, you have to know how to manage it.

Related Content

- Budget Templates for Business & Project Budgeting

- Tracking Budget Variance in Project Management

- Project Budget Template

- Project Budgeting Software

- Budget Reports

- ¿Cómo Hacer un Presupuesto De Un Proyecto?

- Budget de projet : bases de la budgétisation de projet

- Projektbudget: Grundlagen der Projektbudgetierung

- Orçamento do projeto: noções básicas de orçamentação de projetos