When managing a project, many key decisions are required. Project managers strive to control costs while getting the highest return on investment and other benefits for their business or organization. A cost-benefit analysis (CBA) is just what they need to help them do that. Before we explain how to do a cost-benefit analysis, let’s briefly define what it is.

What Is a Cost-Benefit Analysis?

A cost-benefit analysis (CBA) is a process that’s used to estimate the costs and benefits of projects or investments to determine their profitability for an organization. A CBA is a versatile method that’s often used for business administration, project management and public policy decisions. An effective CBA evaluates the following costs and benefits:

Costs

- Direct costs

- Indirect costs

- Intangible costs

- Opportunity costs

- Costs of potential risks

Benefits

- Direct

- Indirect

- Total benefits

- Net benefits

These project costs and benefits are then assigned a monetary value and used to determine the cost-benefit ratio. However, a cost-benefit analysis might also involve other calculations such as return on investment (ROI), internal rate of return (IRR), net present value (NPV) and the payback period (PBP).

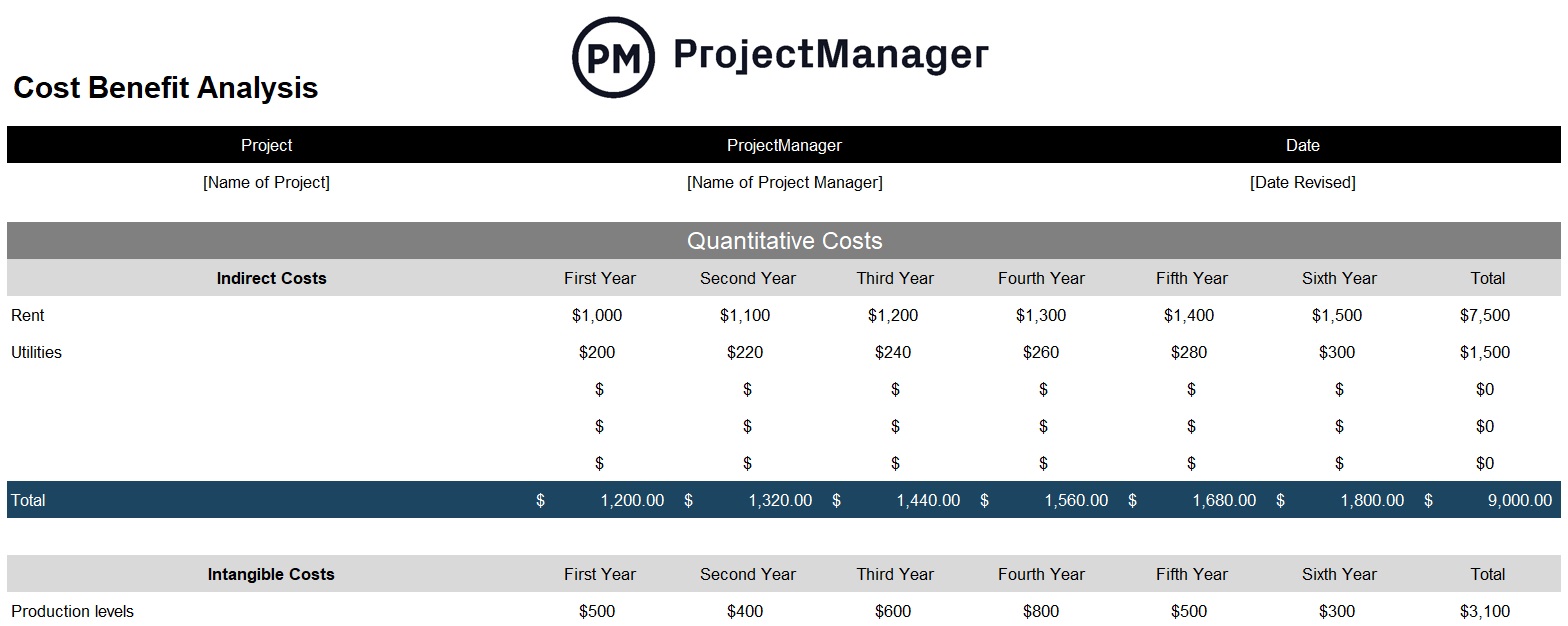

Cost-Benefit Analysis Template

Use this Excel template to put what you’ve learned into practice. This free cost-benefit analysis template helps you identify quanitative costs and benefits, as well as qualitative costs and benefits, so you can appreciate the full impact of your project. Download yours today.

The Purpose of Cost-Benefit Analysis

The purpose of cost-benefit analysis is to have a systemic approach to figure out the pluses and minuses of various business or project proposals. The cost-benefit analysis gives you options and offers the best project budgeting approach to achieve your goal while saving on investment costs.

When to Do a Cost-Benefit Analysis

Cost-benefit analysis is a project cost management technique that helps decision-makers choose the best investment opportunities in different scenarios. Here are some of the most common applications for a cost-benefit analysis in project management.

Cost Benefit Analysis & Cost Management Plan

A project cost management plan is an important document that describes how costs will be estimated, budgeted, tracked and controlled throughout the life cycle of a project, explaining in detail the tools, techniques, procedures and related documentation so the project team and stakeholders are on the same page.

Cost Benefit Analysis & Feasibility Studies

A feasibility study determines whether a project or business initiative is feasible by determining whether it meets technical, economic, legal and market criteria.

Cost Benefit Analysis & Business Requirements Documents

A cost-benefit analysis should be included in a business requirements document, a document that explains what a project entails and what it requires for its successful completion.

Cost Benefit Analysis & Government Projects

Government projects also require conducting a cost-benefit analysis. However, in these types of projects, decision-makers must not only focus on financial gain, but rather think about the impact projects have on the communities and external stakeholders who might benefit from them.

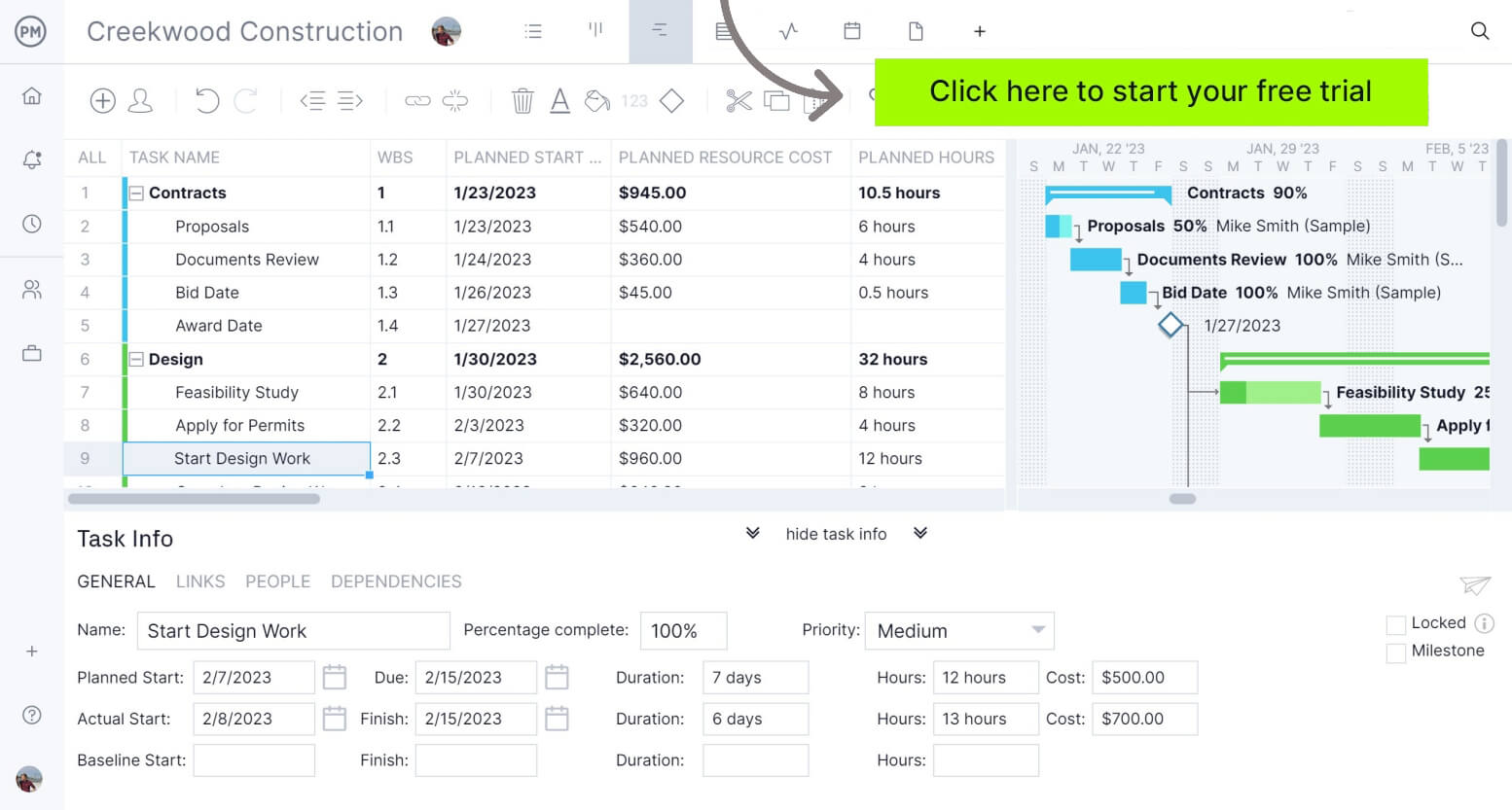

Keeping track of project costs is easier with project management software. For example, ProjectManager has a sheet view, which is exactly like a Gantt but without a visual timeline. You can switch back and forth from the Gantt to the sheet view when you want to just look at your costs in a spreadsheet. You can add as many columns as you like and filter the sheet to capture only the relevant data. Keeping track of your costs and benefits is what makes a successful project. Get started for free today.

How to Do a Cost-Benefit Analysis

According to the Economist, CBA has been around for a long time. In 1772, Benjamin Franklin wrote of its use. But the concept of CBA as we know it dates to Jules Dupuit, a French engineer, who outlined the process in an article in 1848.

Since then, the CBA process has greatly evolved. Let’s go through this checklist to learn how to do a basic cost-benefit analysis using the cost-benefit ratio and present value formulas:

1. What Are the Project Goals and Objectives?

Create a business case for your project and state its goals and objectives.

2. Review Historical Data

Before you can know if a project proposal might be valuable, you need to compare it to similar past projects to see which is the best path forward. Check their success metrics such as their return on investment, internal rate of return, payback period and benefit-cost ratio.

3. Who Are the Stakeholders?

List all stakeholders in the project. They’re the ones affected by the costs and benefits. Describe which of them are decision-makers.

4. What Are the Project Costs and Benefits?

Estimate the future value of your project costs and benefits and think about all the non-financial benefits that a project proposal might bring. There’s a variety of cost estimation tools and techniques that can be utilized such as a cost breakdown structure, parametric estimating, or cost estimating software.

Once project costs are accurately estimated, a cost baseline can be defined, which is the planned cost of the project upon which the project budget is created.

The process can be greatly improved with project management software. ProjectManager has one-click reporting that lets you can create eight different project reports. Get data on project status, variance and more. Reports can be easily shared as PDFs or printed out for stakeholders. Filter any report to display only the data you need at the time.

Get your free

Cost-Benefit Analysis Template

Use this free Cost-Benefit Analysis Template to manage your projects better.

Get the template

5. Define a Project Timeframe

Look over the costs and benefits of the project, assign them a monetary value and map them over a relevant time period. It’s important to understand that the cost-benefit ratio formula factors in the number of periods in which the project is expected to generate benefits.

6. What Is the Rate of Return?

As explained above, the rate of return is used to calculate the present values of your project’s costs and benefits, which are needed to find the cost-benefit ratio.

What Is the Cost-Benefit Ratio?

The cost-benefit ratio, or benefit-cost ratio, is the mathematical relation between the costs and financial benefits of a project. The cost-benefit ratio compares the present value of the estimated costs and benefits of a project or investment.

Cost-Benefit Ratio Formula

This is a simplified version of the cost-benefit ratio formula.

Cost-Benefit Ratio= Sum of Present Value Benefits / Sum of Present Value Costs

Here’s how you should interpret the result of the cost-benefit ratio formula.

- If the result is less than 1: The benefit-cost ratio is negative, therefore the project isn’t a good investment as its expected costs exceed the benefits.

- If the result is greater than 1: The cost-benefit ratio is positive, which means the project will generate financial benefits for the organization and it’s a good investment. The larger the number, the most benefits it’ll generate.

Present Value Formula

The present value of a project’s benefits and costs is calculated with the present value formula (PV).

PV = FV/(1+r)^n

- FV: Future value

- r= Rate of return

- n= Number of periods

We’ll apply these formulas in the cost-benefit analysis example below. Our free cost-benefit analysis template can help you gather the information you need for the cost-benefit ratio analysis.

Cost-Benefit Analysis Example

Now let’s put the formulas reviewed above into practice. For our cost-benefit analysis example, we’ll think about a residential construction project, the renovation of an apartment complex. After using project cost estimation methods and evaluating past-project data, the apartment management company concludes that:

- The project costs are $65,000. They’re paid upfront, so it’s not necessary to calculate their present value

- The project is expected to generate $100,000 in profit for the next 3 years

- The rate of return based on inflation data is 2%

Next, we’ll need to calculate the present value of the benefits expected to be earned in the future using the present value formula:

PV= ($100,000 / (1 + 0.02)^1) + ($100,000 / (1 + 0.02)^2) + ($100,000 / (1 + 0.02)^3)=$288,000

Now we need to use this cost value to find the cost-benefit ratio. Here’s how it would be calculated in this case:

Cost-Benefit Ratio: 288,000/65,000= 4.43

Since we obtained a positive benefit-cost ratio, we can conclude that the project will be profitable for this company. This result implies that the project will generate about $4,43 dollars per each $1 spent to cover expenses.

This is a simple cost-benefit analysis that relies on the cost-benefit ratio to establish the profitability of this project. In other scenarios, you might also need to calculate the return on investment (ROI), internal rate of return (IRR), net present value (NPV) and the payback period (PBP). In addition, it’s advisable to conduct a sensitivity analysis to evaluate different scenarios and how those affect your cost-benefit analysis. Also, it’s important to note that the cost-benefit analysis is simply a forecast and cost control techniques must be implemented to make sure that the figures from the cost-benefit analysis hold true during the project execution phase.

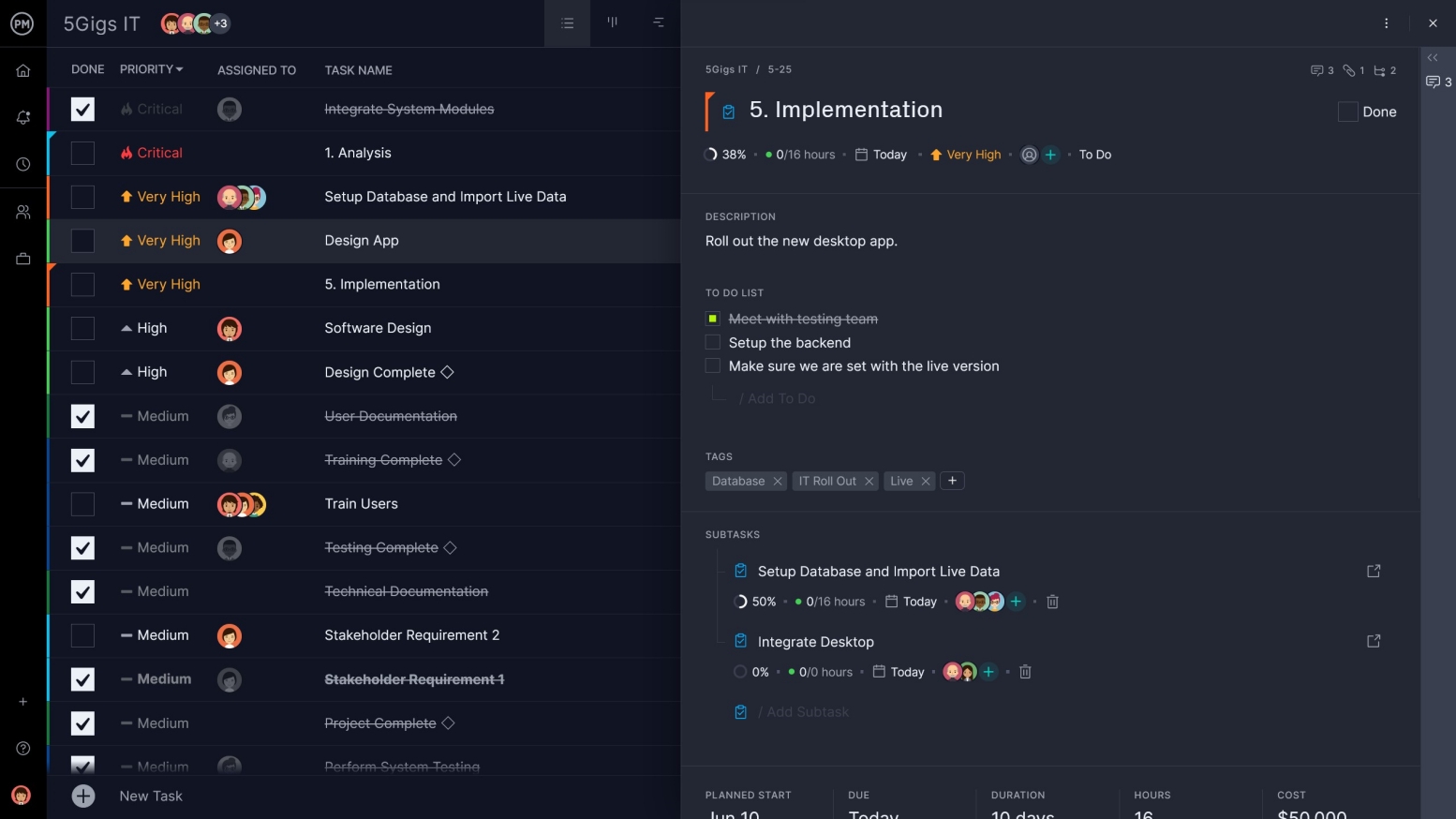

Capture all the costs and benefits with project management software. But unlike many apps with inferior to-do lists, ProjectManager has a list view that is dynamic. It adds priority and customized tags you can assign team members to own each item. Our online tool automatically tracks the percentage complete for each item in real time. All the data you collect in our list view is visible throughout the tool. Regardless of the view, they all update live and they’re ready for you to utilize.

How Accurate Is Cost-Benefit Analysis?

How accurate is CBA? The short answer is it’s as accurate as the data you put into the process. The more accurate your estimates, the more accurate your results.

Some inaccuracies are caused by the following:

- Relying too heavily on data collected from past projects, especially when those projects differ in function, size, etc., from the one you’re working on

- Using subjective impressions when you’re making your assessment

- Improperly using heuristics (problem-solving employing a practical method that is not guaranteed) to get the cost of intangibles

- Failing to factor in potential risks that could cause cost overrun

- Confirmation bias or only using data that backs up what you want to find

Cost-Benefit Analysis Limitations

Cost-benefit analysis is best suited to smaller to mid-sized projects or work plans that don’t take too long to complete. In these cases, the analysis can help decision-makers optimize the benefit-cost ratio of their projects.

However, large projects that go on for a long time can be problematic in terms of CBA. There are outside factors, such as inflation, interest rates, etc., that impact the accuracy of the analysis. In those cases, calculating the net present value, time value of money, discount rates and other metrics can be complicated for most project managers.

There are other methods that complement CBA in assessing larger projects, such as NPV and IRR. Overall, though, the use of CBA is a crucial step in determining if any project is worth pursuing, but does not guarantee that there won’t be issues such as cost variance or cost overrun.

Templates to Help With Your Cost-Benefit Analysis

As you work to calculate the cost-benefit analysis of your project, you can get help from some of the free project management templates we offer on our site. We have dozens of free templates that assist every phase of the project life cycle. For cost-benefit analysis, use these three.

RACI Matrix Template

One of the steps when executing a cost-benefit analysis includes identifying project stakeholders. You need to list those stakeholders, but our free RACI matrix template takes that one step further by outlining who needs to know what. RACI is an acronym for responsible, accountable, consulted and informed. By filling out this template, you’ll organize your team and stakeholders and keep everyone on the same page.

Project Budget Template

You can’t do a cost-benefit analysis without outlining all your expenses first. That’s where our free project budget template comes in. It helps you capture all the expenses related to your project from labor costs, consultant fees, the price of raw materials, software licenses and travel. There’s even space to capture other line items, such as telephone charges, rental space, office equipment, admin and insurance. A thorough budget makes for a more accurate cost analysis.

Project Risk Register Template

You have your stakeholders identified and your budget outlined, but there’s always the unknown to consider. You can’t leave that up to chance: you must manage risk, which is why our free project risk register is so essential. Use it to outline inherent project risks. There are places to list the description of the risk, its impact, the level of risk and who’s responsible for it. By maintaining a risk register, you can control the project variables and make a better cost-benefit analysis.

Make Any Project Profitable With ProjectManager

No matter how great your return on investment might be on paper, a lot of that value can evaporate with poor execution of your project. ProjectManager is award-winning project management software with the tools you need to realize the potential of your project. First, you need an airtight plan.

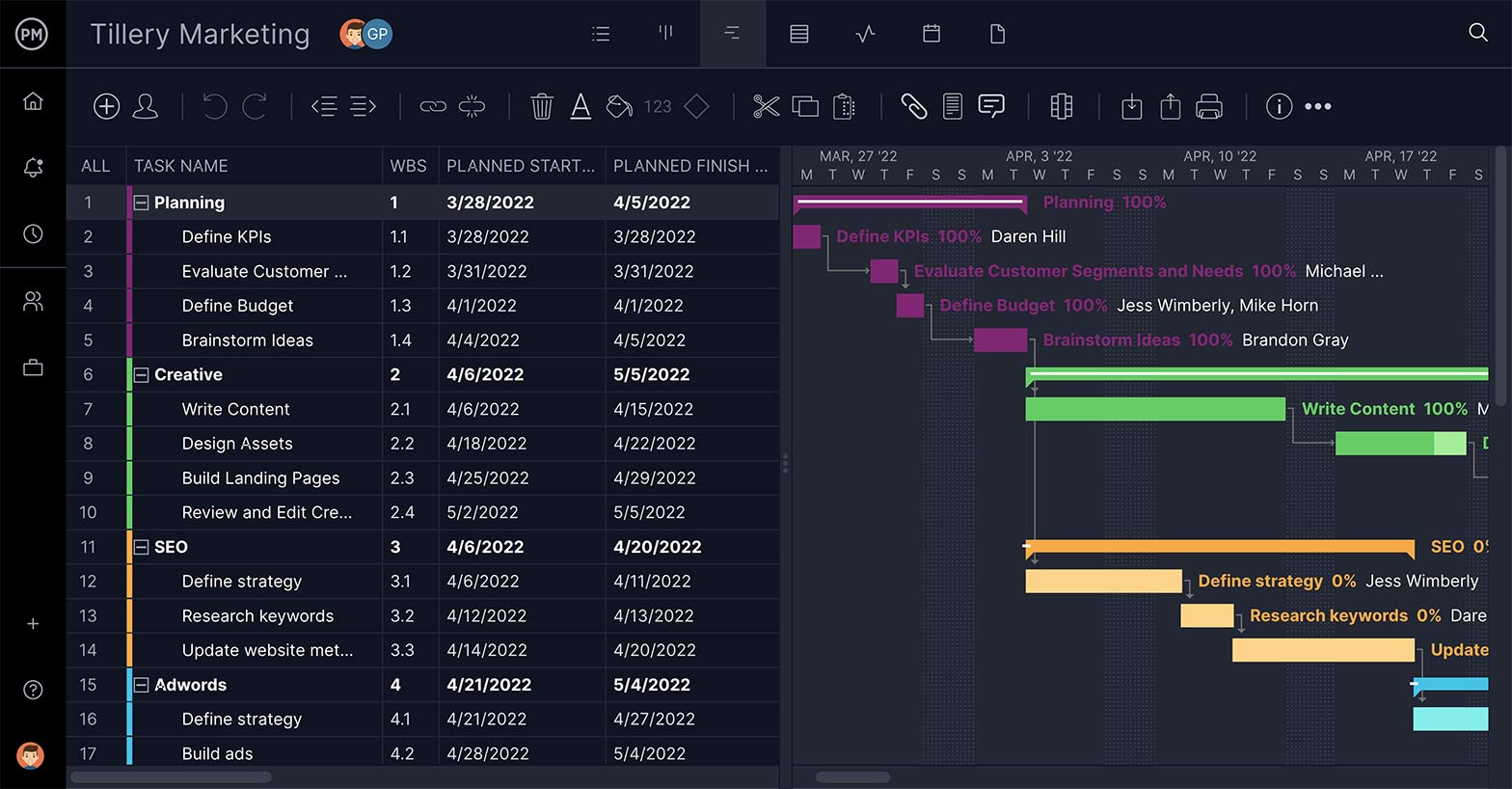

Planning on Gantt Charts

Our online Gantt charts have features to plan your projects and organize your tasks, so they lead to a successful final deliverable. If things change, and they will, the Gantt is easy to edit, so you can pivot quickly.

Resource Management Tools

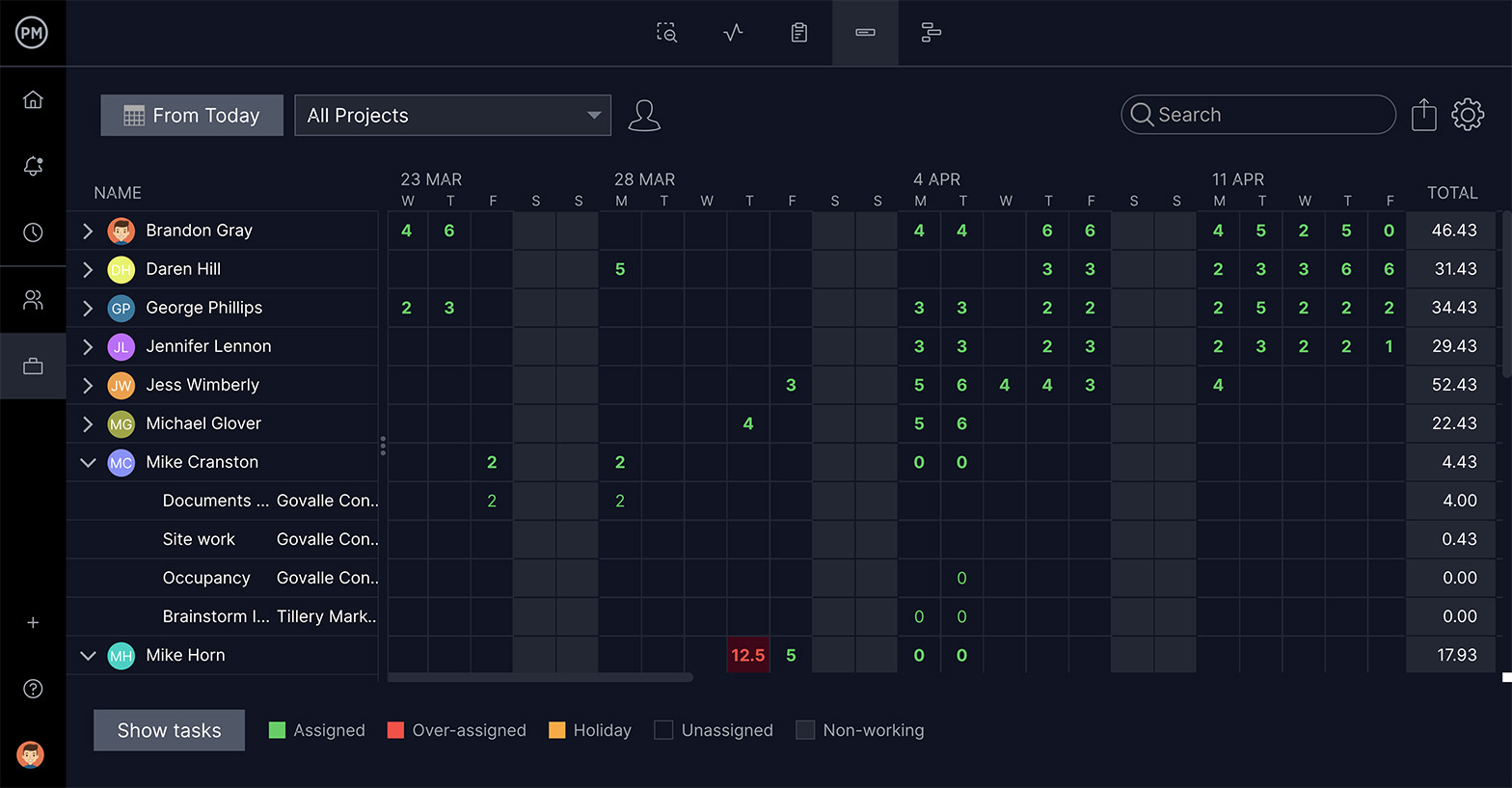

Another snag that can waylay a project is your resources. ProjectManager has resource management tools that track your materials, supplies and your most valuable resource: the project team. If they’re overworked, morale erodes and production suffers.

The workload page on ProjectManager is color-coded to show who is working on what and gives you the tools to reassign to keep the workload balanced and the team productive.

Real-Time Cost Tracking

The surest way to kill any project is for it to bleed money. ProjectManager lets you set a budget for your project from the start. This figure is then reflected in reports and in the charts and graphs of the real-time dashboard, so you’re always aware of how costs are impacting your project. ProjectManager has the features you need to lead your project to profitability.

Related Project Planning Content

- Project Documentation: 15 Essential Project Documents

- How to Create a Project Execution Plan (PEP)

- How to Write a Scope of Work

- Project Scope Statement: How to Write One With Examples

- Cost Performance Index (CPI) In Project Management

- What Is Job Costing? When to Use a Costing Sheet

- Cost of Quality (COQ): A Quick Guide

- El Análisis Costo-Beneficio En Gestión de Proyectos

- Analyse coûts-avantages : guide rapide

- Kosten-Nutzen-Analyse: Ein schneller Leitfaden (mit Vorlage)

Cost benefits analysis is a data-driven process and requires project management software robust enough to digest and distribute the information. ProjectManager is online project management software with tools, such as a real-time dashboard, that can collect, filter and share your results in easy-to-understand graphs and charts. Try it today with this free 30-day trial.