Every business, even a not-for-profit business, needs a budget. A business budget can be looked at as the fuel that drives the business. To understand what that means, we first have to define what a business budget is, which we’ll do in a moment.

This blog also explains the importance of business budgeting and details how to create a business budget. There’s more than one type of business budget and we’ll briefly describe the more common ones. Finally, we’ll show you how to manage a business budget to keep your business viable.

What Is a Business Budget?

A business budget is a company’s spending plan based on its income and expenses. One of the main objectives of a business budget is to identify the business’ available funds and estimate how much will be spent over a period of time. This allows the business to figure out what its revenue will be over that period of time.

A business budget usually covers the period of a year, whether that’s the calendar year or a fiscal year. It lays the foundation for everything the business will do over that coming year, such as how much sales will bring into the business or how much the business should put aside for investment.

All of those questions are hard to answer and impossible to do so with accuracy if the business doesn’t first work out a business budget to forecast the business funds with a great degree of clarity. Another term for the business budget is a financial plan. Whatever you call it, this identifies available resources and helps calculate spending and turnover.

This data will be used in planning the year ahead. Other questions it answers are how much revenue the business must make, what is being allocated for expenditure to generate revenue, how much was spent and what’s left over. A business budget will also help you understand how much money you need for the future in terms of sales, profit and your cash position.

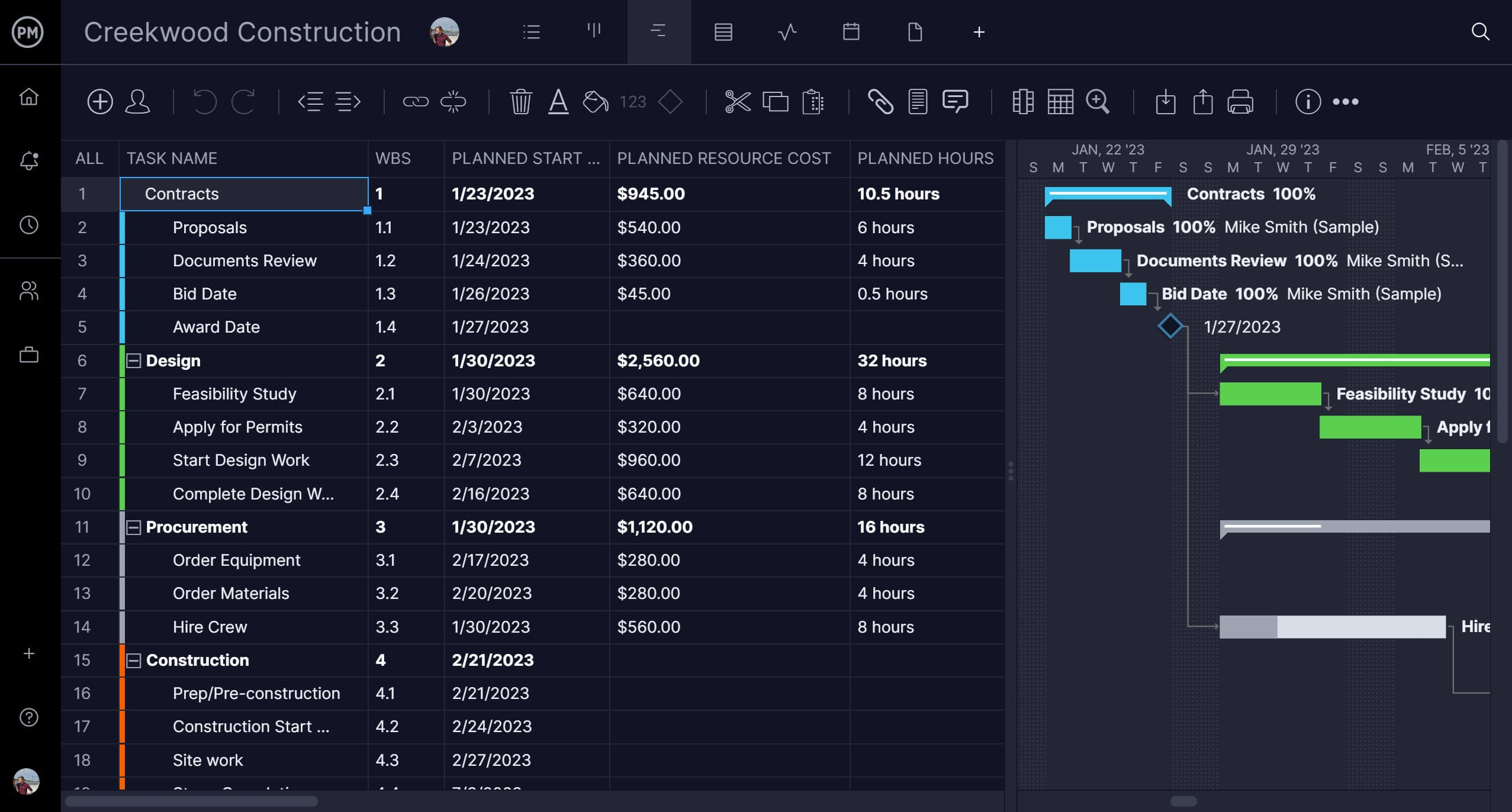

ProjectManager is project management software that helps businesses create a workable budget and track that budget against their financial plan in real time. You can create a budget, manage resources, including human and nonhuman resources, and monitor those costs in real time to ensure you’re sticking to your financial plan. Once you’ve planned your budget on our Gantt chart, you can set a baseline and track your planned budget against your actual budget in real time on our live dashboard or live portfolio dashboard, if you’re managing multiple projects. There’s no setup required. Get started with ProjectManager today for free.

Why Is Business Budgeting Important?

Besides the obvious advantages of forecasting costs and revenue, there are many reasons to make a business budget. For one, it allows a business to prepare for emergencies. Whether those are unforeseen or likely risks, you can set aside funds as a contingency against unexpected expenses.

Having a business budget is also attractive to investors. They’re not gambling with their funds, but carefully placing money with ventures that they believe will generate a return on their investment. When investors see a company that has a well-thought-out business budget, it shows them a business that’s organized and committed, which makes an investor more confident in investing.

A business budget helps the business meet its sales goals by defining how much you expect to sell over the year. It can also help a business meet its financial goals, which means it’ll be around to do business again in the future. Also, if the business has any debt, the business budget can include it in its expenses and thereby pay off the debt.

Then there are taxes. Having a business budget makes it easier for you or your accountant to process your taxes and could even save you money. Any large financial decisions on the horizon will also benefit from the work you’ve put into your business budget. You’ll be in a better position to know if you can afford it or not.

Get your free

Project Budget Template

Use this free Project Budget Template to manage your projects better.

Get the Template

How to Create a Business Budget

It’s time to talk about creating a business budget so you can take advantage of its benefits. This includes maximizing efficiency, achieving your goals and even identifying funds that can be reinvested or predicate slow months to avoid overspending. All of these rewards can be had, but only if you follow these steps to create a business budget.

1. Estimate Your Revenue

First, review your revenue, look at all your revenue sources and determine how much money you make monthly. Historical data that looks back at what you brought in the previous year will help to make a more accurate forecast of what you expect to make in the coming year.

2. Estimate Fixed & Variable Costs

Next, you’ll want to gather your fixed and variable costs to better estimate what they’ll be in the coming year. Fixed costs are those that are constant and don’t often change, such as rent, debt payments, employee salaries, etc. Variable costs are those that do change, which can include hourly wages, raw materials, utility costs that fluctuate due to business activity, etc.

3. Estimate Direct & Indirect Costs

Direct costs are those business expenses that come from a specific project, service, etc. While indirect costs, often referred to as overhead costs, are operating expenses that aren’t attributed to a single project, service, etc. Calculated indirect costs by multiplying the sponsor’s overhead rate by the direct cost base. Indirect costs are calculated by dividing them by the number of units.

4. Create a Contingency Fund

No business budget is perfect so you’ll need to factor in costs for unexpected expenses. That’s called a contingency fund. This should be a percentage of the business budget, enough to repair broken-down equipment, replace inventory, etc.

5. Create Your Budget Based on Revenue and Costs

Now that you have an estimate of your revenue and costs, or expenses for the coming year, the next step is to create the business budget. You’ll want to look at the marketplace to fine-tune your figures to reflect the demand you expect for your business.

6. Estimate Your Profit

Once you’ve added all your projected revenue and costs for the coming year, subtract the expenses from the revenue to figure out what your profits will be. This can then be set up as monthly goals so make sure they’re realistic.

Related: 15 Excel Spreadsheet Templates for Tracking Tasks, Costs and Time

Types of Business Budgets

There are many different business budgets and they each focus on various financial aspects of the business. Knowing which business budget is the right one for your business is critical. Here are some of the more common types of business budgets.

Master Budget

As the name suggests, this is the budget that collects all the other budgets. It’s the complete financial picture of a business and shows where specific income and expenses fit in the overall business. These are common with larger businesses, but not unheard of for smaller ones that want to break down finances by departments or categories.

Operating Budget

This budget is the expenses and revenues related to the operations of a business. That is the funds used to run the business. This is where you deal with fixed and variable costs, revenue and whatever other expenses. It’s likely that this budget will include budgets for sales, production, direct materials and labor, overhead and administrative costs.

Cash Flow Budget

Cash flow is the money that comes in or goes out of a business over a specific period. Therefore, the cash flow budget is used to make insightful decisions about cash flow, identify any issues and stop the business from overspending. The cash flow budget helps a business ensure that they have enough cash coming in to cover what’s going out to avoid a negative cash flow.

Financial Budget

This budget is used to understand how much money is needed to meet long- and short-term goals. It includes factors such as assets, liabilities and equity from a business’s balance sheet. It’s a budget that gauges the health of a business and how stable it is and is often used when looking for funding or thinking about going public.

Labor Budget

A labor budget is used to figure out how many employees you need to achieve your business goals. It’s also used to pay those employees you have under your employ and plan payroll costs. If your business uses seasonal employees, then the labor budget will help with allocating expenses for that as well.

Static Budget

This budget is used to collect those sales and expenses that are predictable and don’t change over the course of the year. Some examples include software, contractor fees, warehouse rent, etc. Since these items aren’t impacted by sales volume or changes in the business, they can help you evaluate sales performance.

How to Manage a Business Budget

Creating a business budget, whichever type you need, is only the starting point. Once done you then have to manage it. Budgetary management is the process of overseeing and tracking income and expenses throughout the year. There are a number of different ways you can do this. Here are three.

Budget Forecasting

Also called a financial forecast, is a tool to evaluate a business’s current financial performance and the economic conditions in which it operates in order to estimate what the future business revenue and expenditure trends are likely to be.

Budget Planning

A budget plan is a process used to develop a budget and then use that budget to control business operations. By planning a budget, you can reduce risk that could negatively impact business operations.

Budget Tracking

In order to stick to your business budget, you need to track expenses, receipts and invoices to make sure you’re not going over your allotted budget. Software can help you track your costs in real time to make necessary adjustments to stay aligned with your budget.

ProjectManager Has Budgeting Features

ProjectManager is award-winning project management software with robust tools to manage budgets and costs. You can create a budget at any time or change it through product settings. There are two types of costs, resource costs (both human and nonhuman) and general costs. Our powerful Gantt charts help you organize your costs and then, once you set a baseline, those planned costs can be compared to your actual costs in order to make sure you’re keeping to your budget.

Plan and Manage Resource Costs

Resources, both human and nonhuman, can make or break your business budget. Our software has the tools to help you plan those resources and associated costs on our Gantt chart. You can view your planned costs against your actual costs after you’ve made assignments. To monitor those resources and ensure that they’re working at capacity, toggle to our workload chart. It’s color-coded, making it easy to see everyone’s allocation and you can balance their workload from the chart to keep the team productive.

Generate Detailed Cost Reports

Managers and stakeholders need to keep track of cost and budget data. There are multiple types of reports that can be quickly created to display this cost information. The portfolio status report shows a color-coded cost column that makes it easy to see if your project is over or under budget. Similarly, there is a project status report that provides the same information, but for a single project. The project plan report states the costs spent to date. The task report displays planned and actual costs, planned and actual resource costs. All of these reports can be filtered to show only the data you want to see and shared in a number of different formats so they can be presented to stakeholders to keep them updated.

Our software can set up and track your budget in real time, but we also have task, risk and resource management features to control your cost and help you avoid overspending. Automated workflows add efficiency to your processes and task approval ensures that you maintain quality expectations throughout that process.

ProjectManager is online project management software that helps you plan, manage and track your budget in real time. Our collaborative platform enables you to share files, comment and connect with everyone on your team, anywhere and anytime. Join teams at companies as varied as Avis, Nestle and Siemens who use our software. Get started with ProjectManager today for free.