Well-run organizations don’t fly by the seat of their pants; they’re constantly working on business forecasting and business planning. Every decision and every process is based on data obtained from business forecasting, business intelligence tools, market research and scenario planning. Companies focus their energies on ways to predict market trends to help them set successful long-term strategies.

Some business forecasts are based on highly sophisticated statistical methods while others are based on experience and past data. Others simply follow a gut feeling. One thing remains constant: all industries rely on business forecasting.

What Is Business Forecasting?

Business forecasting refers to the process of predicting future market conditions by using business intelligence tools and forecasting methods to analyze historical data.

Business forecasting can be either qualitative or quantitative. Quantitative business forecasting relies on subject matter experts and market research while quantitative business forecasting focuses only on data analysis.

You can access historical data with project management tools such as ProjectManager, project management software that delivers real-time data for more insightful business forecasting. Our live dashboard requires no setup and automatically captures six project metrics which are displayed in easy-to-read graphs and charts. Get a high-level view of your project for better business planning. Get started with ProjectManager for free today.

Quantitative Forecasting

Quantitative forecasting is applicable when there is accurate past data available to predict the probability of future events. This method pulls patterns from the data that allow for more probable outcomes. The data used in quantitative forecasting can include in-house data such as sales numbers and professionally gathered data such as census statistics. Generally, quantitative forecasting seeks to connect different variables in order to establish cause and effect relationships that can be exploited to benefit the business.

Qualitative Forecasting

Qualitative forecasting is based on the opinion and judgment of consumers and experts. This business forecasting method is useful if you have insufficient historical data to make any statistically relevant conclusions. In such cases, an expert can help piece together the known bits of data you do have to try to make a qualitative prediction from that known information.

Qualitative business forecasting is also useful when little is known about the future in your industry. Relying on historical data is useless if that data is not relevant to the uncharted future you are approaching. This can be the case in innovative industries, or if there’s a new constraint entering the market that has never occurred before such as new tax law.

The Importance of Business Forecasting

Business forecasting is critical for businesses whenever the future is uncertain or whenever an important strategic business decision is being made. The more the business can focus on the probable outcome, the more success the organization has as it moves forward.

Business Forecasting Process

Here are the steps that a business forecaster should typically follow:

- Define the question or problem you need to solve with your business forecasting efforts. For example, you might be interested in estimating whether your organization will be able to meet product demand for the next quarter.

- Identify the datasets and variables that need to be taken into consideration. In this case, datasets such as the sales records from the previous year and variables related to capacity, production and demand planning.

- Choose a business forecasting method that adjusts to your dataset and forecasting goals. That depends on whether your problem or question can be solved using a qualitative, quantitative or mixed approach.

- Based on the analysis of historical data, you can proceed to estimate future business performance. Keep in mind that the accuracy of your business forecasting depends on the quality of your data.

- Determine the discrepancy between your business forecast and actual business performance. Document your findings and improve your business forecasting process.

Business Forecasting Methods

As stated above, there are two main types of business forecasting methods, qualitative and quantitative. We’ve compiled some of the more common forecasting models from both sides below.

Delphi Method

This qualitative business forecasting method consists in gathering a panel of subject matter experts and getting their opinions on the same topic in a manner in which they can’t know each other’s thoughts. This is done to prevent bias, which makes it possible for a manager to objectively compare their opinions and see if there are patterns, consensus or division.

Market Research

There are many market research techniques that evaluate the behavior of customers and their response to a certain product or service. Some of those market research methods collect and analyze quantitative data, such as digital marketing metrics and others qualitative data, such as product testing, or customer interviews.

Time Series Analysis

Also referred to as “trend analysis method,” this business forecasting technique simply requires the forecaster to analyze historical data to identify trends. This data analysis process requires statistical analysis as outliers need to be removed. More recent data should be given more weight to better reflect the current state of the business.

The Average Approach

The average approach says that the predictions of all future values are equal to the mean of the past data. Past data is required to use this method, so it can be considered a type of quantitative forecasting. This approach is often used when you need to predict unknown values as it allows you to make calculations based on past averages, where one assumes that the future will closely resemble the past.

The Naïve Approach

The naïve approach is the most cost-effective and is often used as a benchmark to compare against more sophisticated methods. It’s only used for time series data where forecasts are made equal to the last observed value. This approach is useful in industries and sectors where past patterns are unlikely to be reproduced in the future. In such cases, the most recent observed value may prove to be the most informative.

Elements of Business Forecasting

- Develop the Basis: Before you can start forecasting, you must develop a system to investigate the current economic situation around you. That includes your industry and its present position as well as its popular products to better estimate sales and general business operations.

- Estimating Future Business Operations: Now comes the estimation of future conditions, such as the course that future events are likely to take in your industry. Again, this is based on collected data to help with quantitative estimates for the scale of operations in the future.

- Regulating Forecasts: Whatever your forecast is, it must be compared to actual results. This is the only way to find deviations from the norm. Then the reasons for those deviations must be figured out, so action can be taken to correct those deviations in the future.

- Reviewing Forecasting Process: By reviewing the deviations between forecasts and actual performance data, improvements are made in the process, allowing you to refine and review the information for accuracy.

Sources of Data for Forecasting

Your forecast will only be as good as the data you put into it. Before collecting data, ask yourself these questions:

- Why collect data?

- What kind of data?

- When to collect it?

- Where to collect it?

- Who will collect it?

- How will it be collected?

These are the questions that will shape your plan for the collection of data, a crucial facet of business forecasting. Once you have your plan, you can collect data from a variety of sources.

Primary Sources

Primary sources contain first-hand data, often collected with reporting tools. These are the ones that you or the person assigned this task to collect personally. If primary data is not available, you must go out and source it through interviews, questionnaires or observations.

Secondary Sources

Secondary sources contain published data or data that has been collected by others. This includes official reports from governments, publications, financial statements from banks or other financial institutions, annual reports of companies, journals, newspapers, magazines and other periodicals.

Business Forecasting Only Goes So Far

If business forecasting were a crystal ball, then everyone would be reaping the rewards of their foresight. While business forecasting is a tool to get a better view of what the future might have in store, there’s the argument that it’s wasting valuable time and resources on little return.

It’s true; you can follow the steps, use a variety of methodologies and still get it wrong. It is, after all, the future. There’s no way to ever manage all the variables that can impact future events. There are errors in calculations and the innate prejudices of the people managing the process, all of which add to the unpredictability of the results.

While you’re not going to have a clear, unobscured vision of the future by using business forecasting, it can provide you with insight into probable future trends to give your organization an advantage. Even a small step can be a great leap forward in the highly competitive world of business. By combining statistical and econometric models with experience, skill and objectivity, business forecasting is a formidable tool for any organization looking for a competitive advantage.

How ProjectManager Helps Business Forecasting

Clearly, business forecasting is a project unto itself. To manage a project and collect the data in a way that’s useful in the future, you need a project management tool that can help you plan your process and select the data that helps you decide on a way forward.

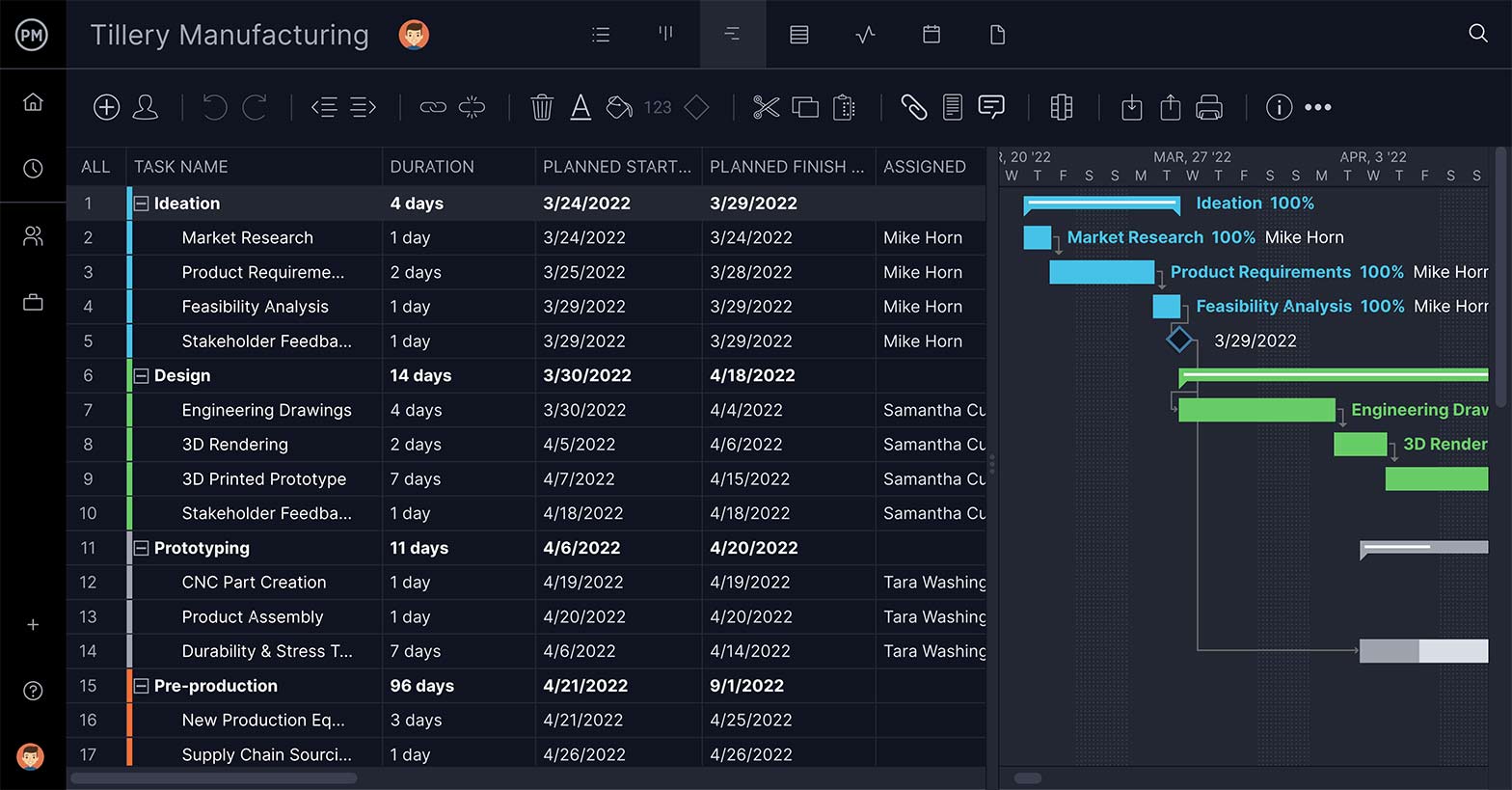

ProjectManager is award-winning software that organizes projects with features that address every phase. The first thing in forecasting is choosing how you’ll take action and make a plan. For example, if you’re going to interview customers to see where the market is likely headed, you’ll need to schedule those interviews. Our online Gantt chart places those interviews as tasks on a timeline so you can get everyone interviewed before your deadline.

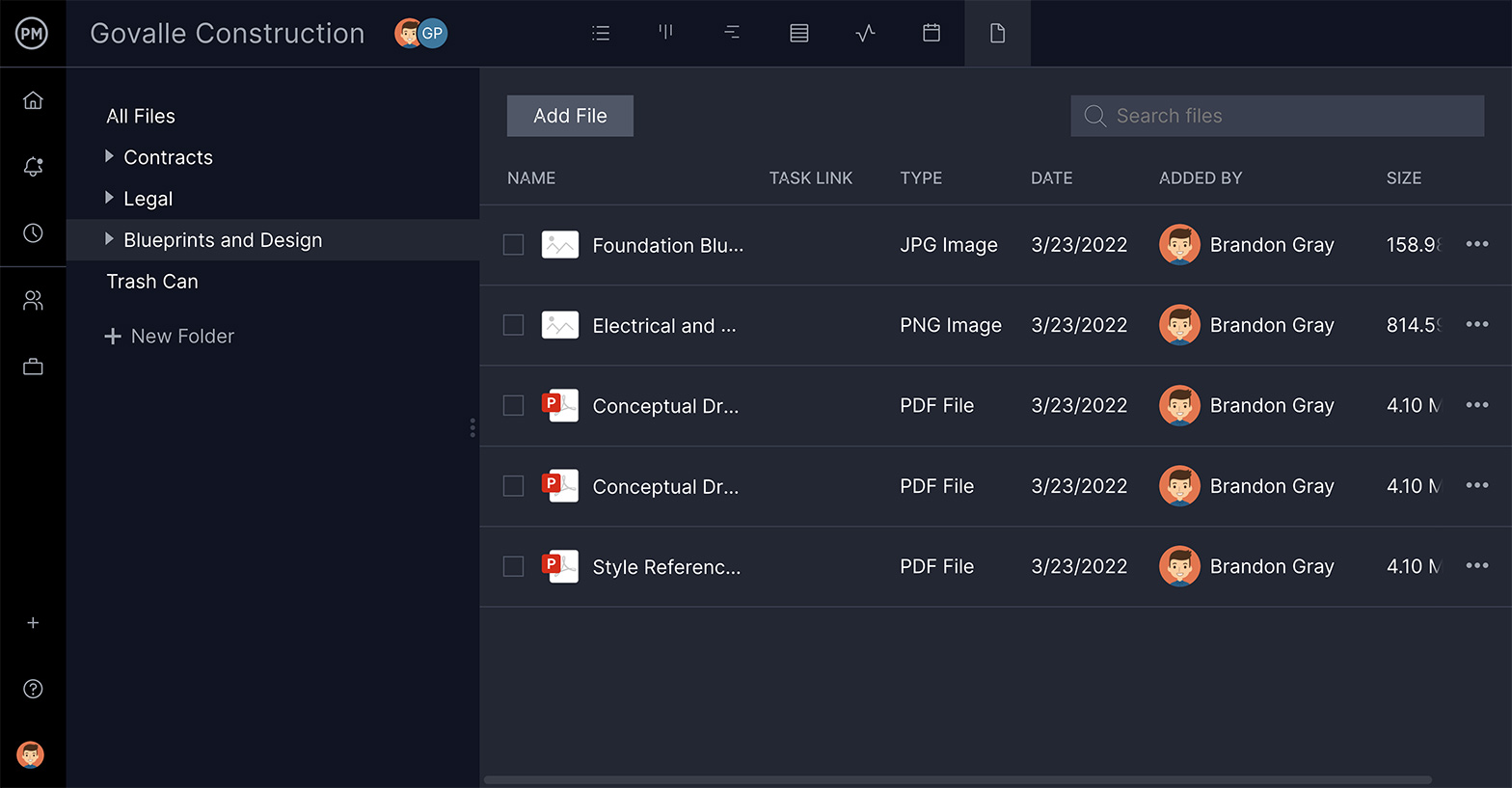

Store All of Your Data in One Place

Those interviews will produce a lot of paperwork, and your data needs to be collected and stored somewhere easily accessible. You can attach notes to each task so the paperwork for each interviewee is saved with the notes that you took. You can also tag those tasks to make it easier to filter the project and locate the interview subjects for which you’re looking. If you’re worried that there’ll be too many documents and images attached to one task, don’t worry as we have unlimited file storage.

ProjectManager can’t predict the future, but it does provide you with the tools you need to take advantage of business forecasting. Our project management software collects data in real-time, and stores past data, allowing you to filter information and pull up the metrics you need to make the right decision. Try it today with this free 30-day trial.