A budget plan template is a structured outline of expected income and planned expenses over a specific period, such as weekly, monthly or annually. It helps individuals and organizations manage resources, track spending and achieve financial goals. By defining where money comes from and where it goes, a budget plan provides insight into spending habits and highlights areas for potential savings or reallocation.

Whether for personal finance, business planning, project management or government and non-profits, a budget plan keeps finances organized and transparent. In personal finance, it helps manage household expenses, save for goals and avoid debt. In business, it allows managers to allocate funds across departments, projects and periods. For projects, it estimates costs and tracks spending against allocated resources. Non-profits and government agencies can use it to plan and justify the use of public or donor funds, ensuring accountability and efficiency.

Why Use a Budget Plan Template?

A budget plan template for Excel makes financial management simple and flexible. Excel’s familiar interface allows users to enter data quickly, update figures as circumstances change and generate summaries for review. Unlike manual calculations or paper spreadsheets, an Excel template automatically totals income and expenses, highlights discrepancies and provides a clear snapshot of your financial situation.

This free budget plan template helps anyone stay organized without investing in expensive software. Customize the template to match your unique financial needs, track recurring payments and one-time costs and visualize your progress toward savings or spending goals. With the right template, budgeting becomes a proactive tool rather than a reactive chore, giving you confidence and control over your finances.

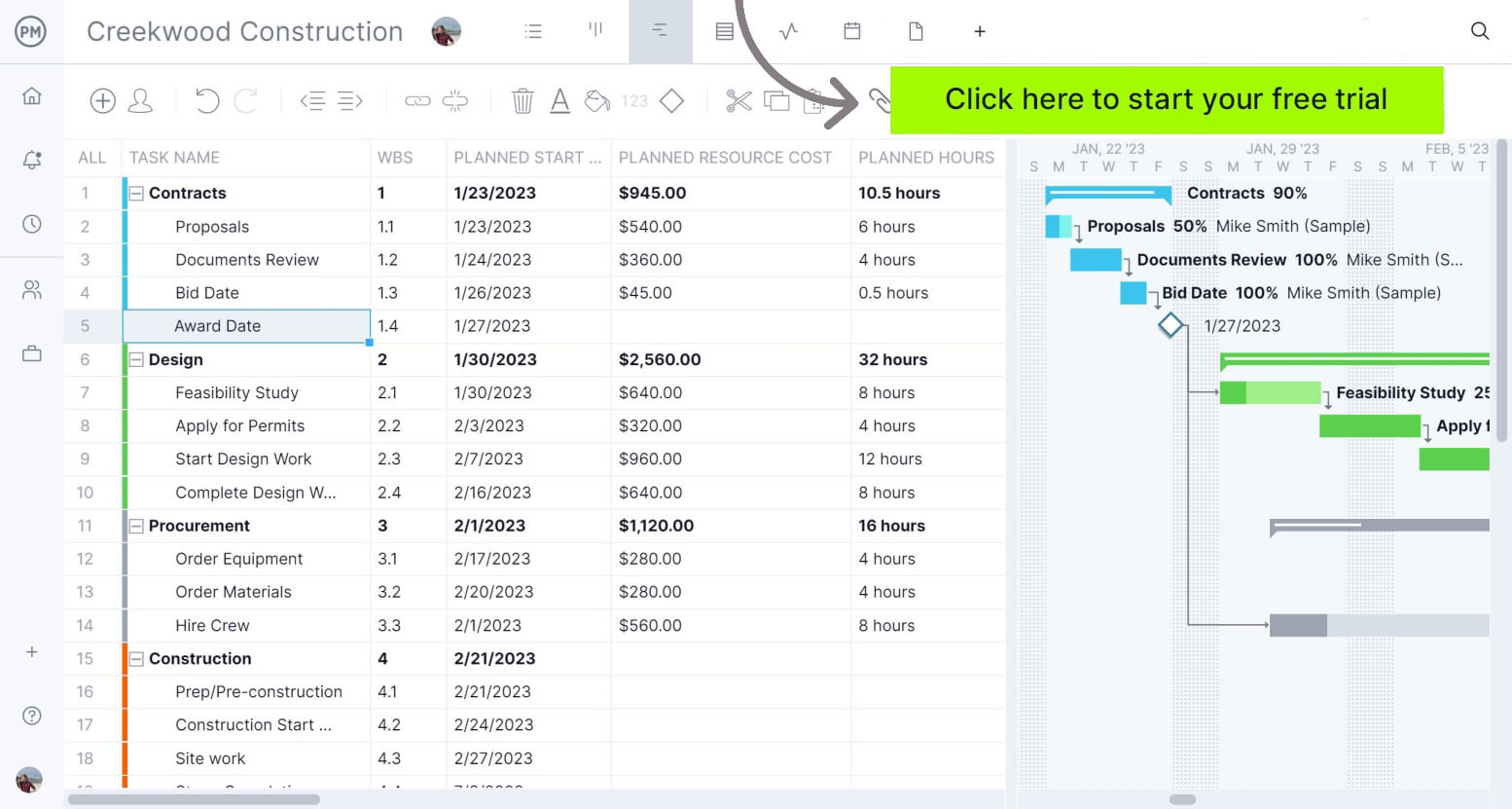

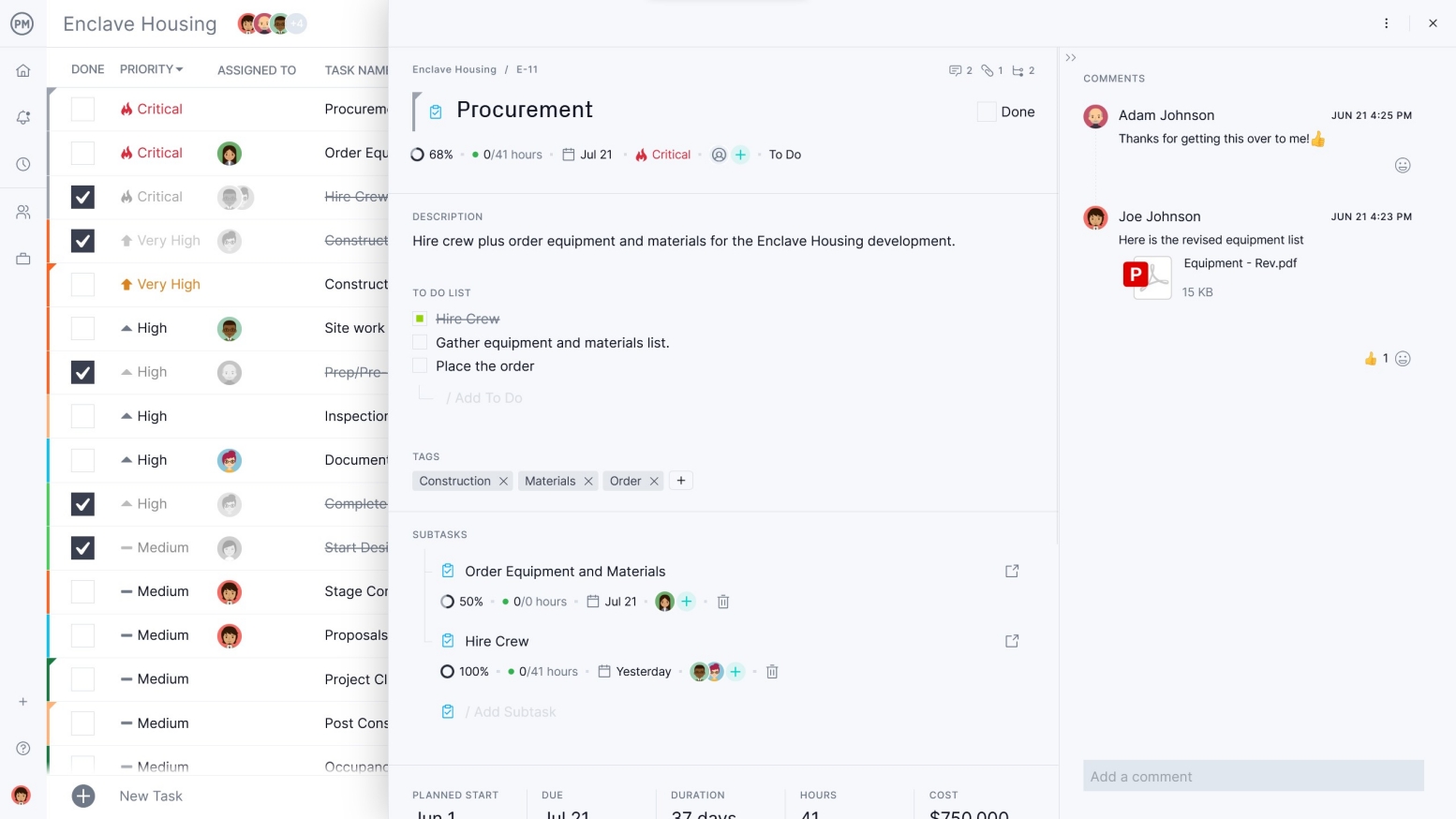

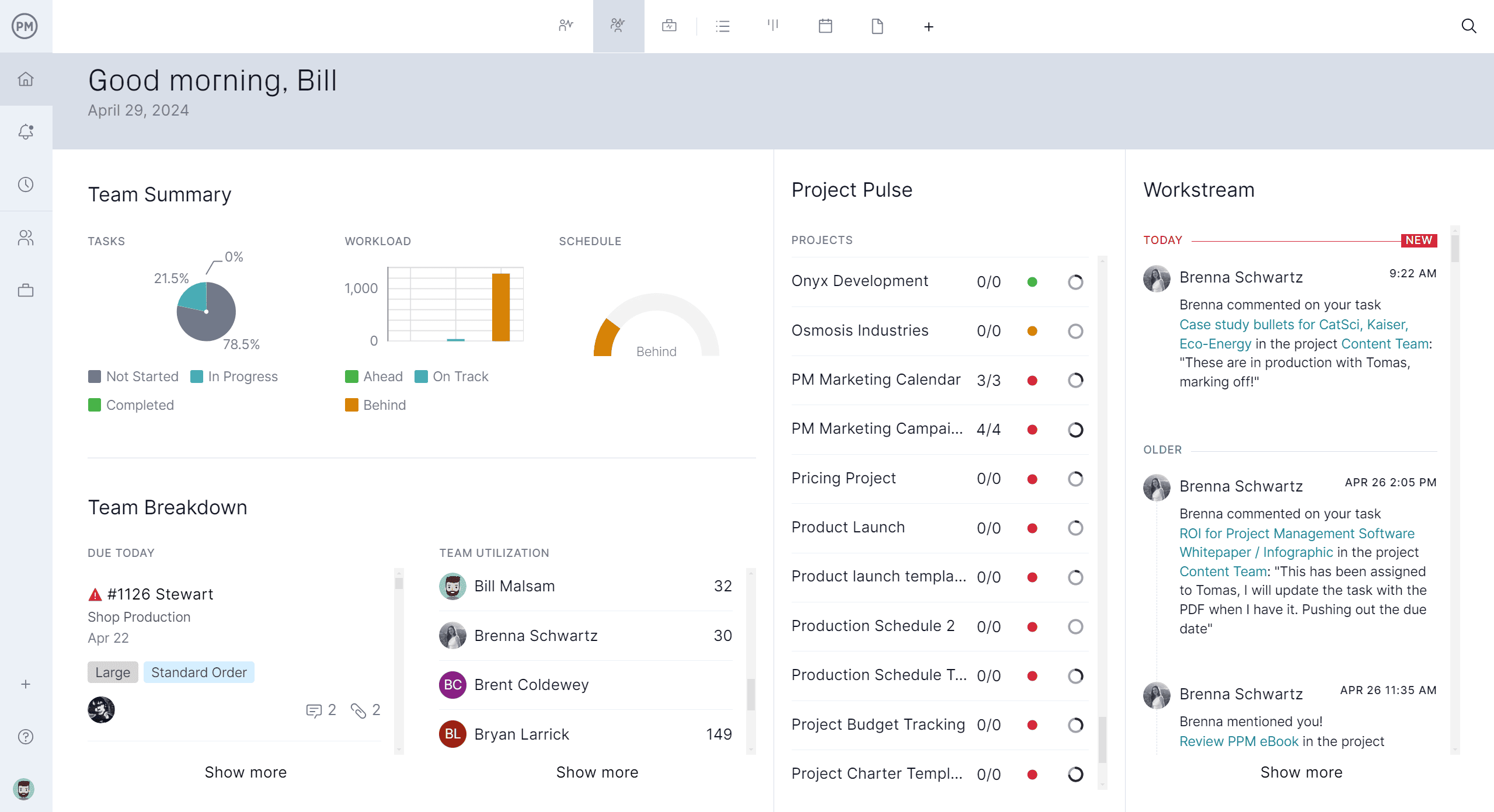

Project management software is the best way to plan, manage and track budgets because it combines real-time visibility with flexible organization. Unlike static spreadsheets or templates, it allows teams to forecast costs, allocate resources and monitor spending throughout a project’s lifecycle. By centralizing all budget information in one place, project managers can quickly identify potential overruns, adjust plans and ensure that projects stay on track financially. This integrated approach reduces errors, improves accountability and gives stakeholders a picture of how funds are being used.

ProjectManager takes budget management a step further by providing intuitive tools like Gantt charts to visualize project timelines alongside costs. With Gantt charts, managers can see which tasks impact the budget, adjust schedules to optimize spending and anticipate resource needs. They can link all four types of task dependencies to avoid cost overruns, filter for the critical path to identify tasks with zero slack and set a baseline to track costs in real time. Get started with ProjectManager today for free.

When to Use a Budget Plan Template

A budget plan template should be used whenever you need a clear and organized way to manage income and expenses. It works well at the start of a new financial period, such as a week, month or year, to plan spending and savings goals. Individuals can use it to track household expenses, avoid debt and save for future priorities.

Businesses and projects benefit from a budget plan template to allocate funds across departments, initiatives or tasks and monitor actual spending against resources. Non-profits and government agencies can also use it to justify the use of public or donor funds and maintain transparency. Any time you want to make informed financial decisions and keep control over money, a budget plan template provides a structured and easy-to-follow guide.

Who Should Use This Budget Plan Template?

Anyone who wants to organize and control their finances can use a budget plan template. Individuals can track household expenses, manage savings goals and avoid overspending. Small business owners and managers can plan departmental budgets, allocate resources to projects and monitor costs against income.

Project teams can use it to estimate expenses, track spending and keep projects on budget. Non-profits and government organizations can plan and justify the use of public or donor funds while maintaining accountability. Anyone looking for a simple, structured way to manage money and make informed financial decisions will benefit from using a budget plan template.

How to Use the Budget Plan Template for Excel

This free budget plan template for Excel makes managing your finances simple and efficient. The template is preformatted to track income and expenses, allowing you to see where your money is going and plan. By following the steps below, you can customize the template to fit your personal, business or project needs and make informed financial decisions.

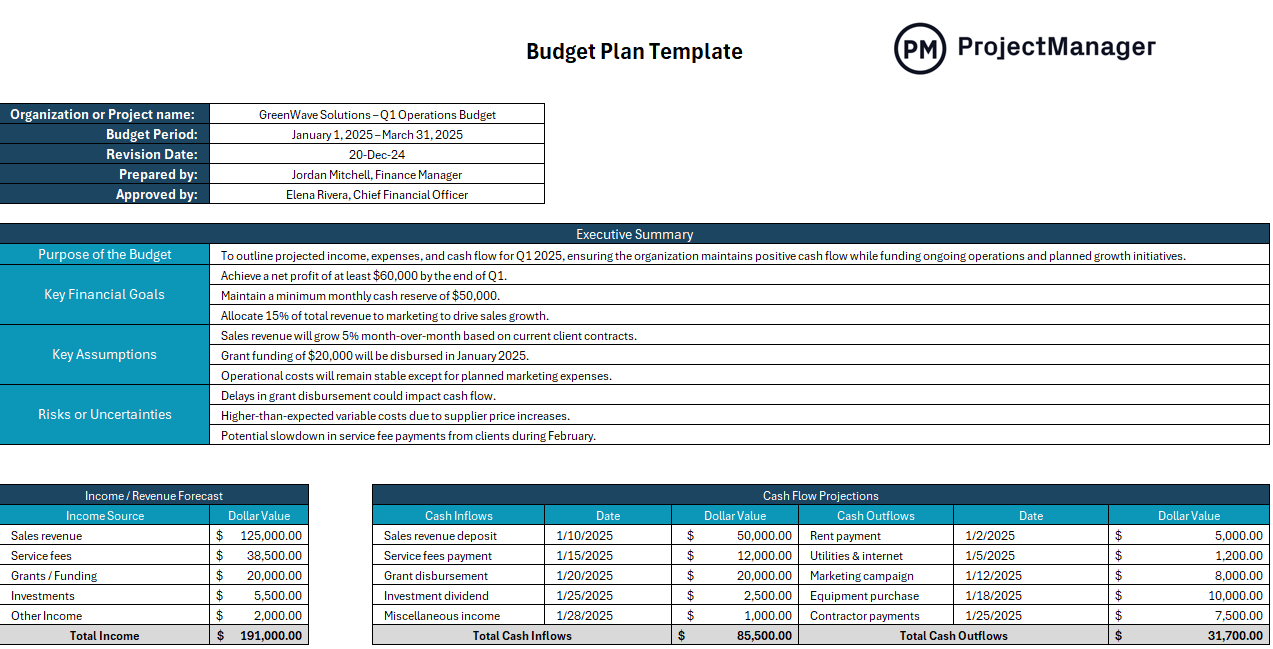

Step 1: Organization or Project Info

Begin by listing the name of the organization or project, then add the budget period. If the document has been updated, note that date here. Also, provide who prepared the spreadsheet and who approved it.

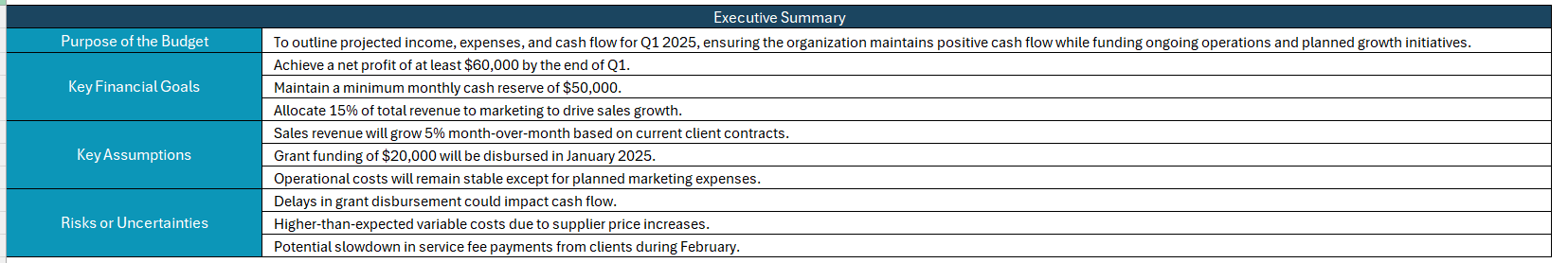

Step 2: Executive Summary

Here you’ll want to outline the purpose of the budget, key financial goals, assumptions and risks or uncertainties.

Step 3: Enter Your Income

Now, list all sources of income in the designated income section. Include salaries, business revenue, investment returns or any other incoming funds. This will give you a clear picture of the total money available for your budget period.

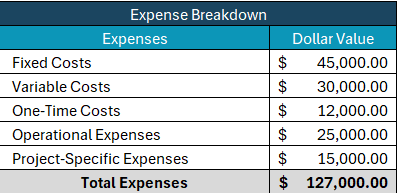

Step 4: Add Your Expenses

Next, input your planned expenses in the appropriate categories. For personal finance, this might include housing, transportation, food and entertainment. For business or project budgets, break down expenses by department, project or operational cost. The template will automatically calculate totals for each category.

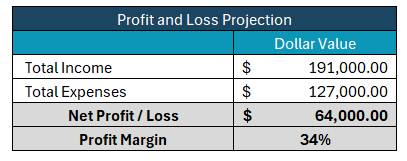

Step 5: Compare Income and Expenses

Once income and expenses are entered, review the comparison section to see if you are over or under budget. This helps you make adjustments such as reducing unnecessary costs or reallocating funds to important areas.

Step 6: Track Actual Spending

Update the template regularly with actual spending. This allows you to compare planned versus actual expenses, identify discrepancies and adjust future spending. Keeping this updated ensures your budget remains accurate and actionable.

Step 7: Analyze and Adjust

Use the template’s summary and totals to analyze trends over time. Identify areas where you can save or improve efficiency. Adjust your budget plan as needed to meet your financial goals and maintain control over your finances.

Related Budget Templates

A budget plan template is only one of the many project management templates for Excel and Word available for free download immediately from our site. These free templates cover all aspects of managing a project. Below are just a few examples that can help with budget planning.

Balance Sheet Template

Download this free balance sheet template to organize and display a company’s financial position at a specific point in time. It provides a structured way to record assets, liabilities and equity, which are the three main components of a balance sheet. Using a template ensures consistency, accuracy, and ease of updating financial information.

Profit and Loss Statement Template

Use this free profit and loss statement template to summarize a business’s revenues, costs and expenses over a specific period to determine net profit or loss. It provides a clear framework for tracking income and spending and helps business owners, managers, and accountants understand financial performance.

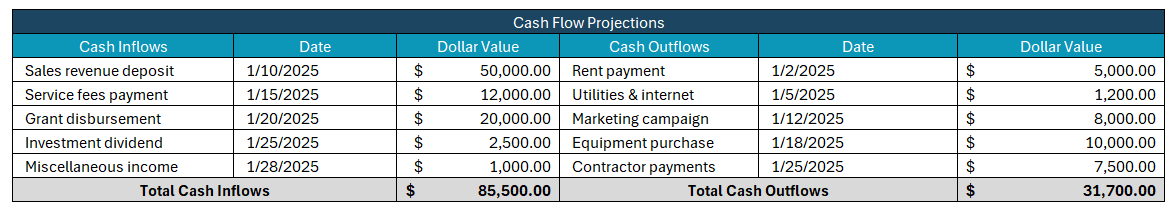

Cash Flow Statement Template

This free cash flow statement template is used to track the inflows and outflows of cash in a business over a specific period. It shows how cash is generated and spent, helping businesses understand liquidity and plan for future financial needs.

Budget Dashboard

A free budget dashboard is a predesigned tool that allows businesses or individuals to visualize, track and manage their budget in one centralized view. It combines financial data, charts and key metrics to provide an at-a-glance picture of spending versus the planned budget.

ProjectManager Is Better for Budget Management Than Templates

ProjectManager transforms budget management from a static, manual process into a dynamic, real-time financial control system. Unlike traditional templates, which require constant updates and manual calculations, our software integrates budget tracking with the full project workflow.

You can assign tasks, allocate resources and set budget limits, while the software automatically calculates labor and material costs. Alerts notify you when resources are over-allocated or costs exceed estimates, helping your team stay on budget without constant oversight.

Leverage Multiple Project Views

Beyond Gantt charts, there are kanban boards, task lists, calendars and portfolio views, all of which provide unique budgeting insights. Kanban boards let you track costs at each workflow stage, task lists break down expenses per assignment and calendars ensure key payments and purchases are scheduled. P

ortfolio views enable managers to compare budgets across multiple projects simultaneously. With these diverse perspectives, you can plan, adjust and optimize spending across every project detail.

Track Budgets in Real Time

With interactive, real-time project and portfolio dashboards, customizable reports and timesheet integration, users can monitor budgets continuously. Dashboards display spending versus planned costs instantly, while reports summarize financial performance by project, resource or phase.

Integrated timesheets link labor hours directly to costs, providing an accurate, up-to-the-minute view of your budget. This real-time tracking ensures you catch overruns early, make informed decisions and maintain full financial control.

Related Budget Management Content

Looking to learn more about budget management beyond a budget plan template? You’ve come to the right place. We publish weekly blogs, tutorial videos and tons of free templates. Below are just a few that relate to the topic.

- How to Make a Project Budget

- Project Budget Tracking: A Step-by-Step Guide

- Construction Budget: A Quick Guide

- How to Create a Marketing Budget: A Quick Guide

- Free Budget Tracker for Google Sheets

- 13 Budget Templates for Business & Project Budgeting

ProjectManager is online project and portfolio management software that connects teams whether they’re in the office or out in the field. They can share files, comment at the task level and stay updated with email and in-app notifications. Join teams at Avis, Nestle and Siemens who are using our software to deliver successful projects. Get started with ProjectManager today for free.